In this article, we will discuss how to calculate the credit debt ratio and what criteria lenders use in determining your borrowing capacity. Also, we will discuss the effect of high debt levels on your credit score. Finally, we will offer some tips to help you lower your debt. Hopefully, this information will help you to make the best borrowing decisions possible. We will also discuss some common causes of high credit debt.

Calculating a credit debt ratio

Many lenders calculate their debt to credit ratios to determine if you're a good candidate for a loan. Generally, they prefer to see this ratio below 30 percent. A higher ratio can signal that you are a risky borrower, which could negatively impact your credit score. There are ways to reduce your debt-to credit ratio and avoid the negative consequences.

Paying down your credit card balances can help reduce your debt-to-credit ratio. You can improve your credit score by keeping your credit card balances below 30% of your total credit lines. Paying off balances should be your priority. Your debt to credit ratio should be low in order to make informed decisions when taking out loans and purchasing items on credit. You can monitor your ratio to understand the benefits of paying more than the minimum.

Lenders use a variety of criteria to determine borrowing ability

Lenders determine borrowing power by assessing a person’s credit score and financial situation. Higher borrowing power will be determined by your credit score. A higher credit score will enable you to borrow more money with better interest rates. There are certain things that you should consider before you apply for a loan, regardless of your credit score.

The first step in determining the borrower's borrowing power is to analyze their income. The real-life serviceability calculation is used for this purpose. This calculator looks similar to one used by most banks. Next, you will need to decide if the borrower is able to make the monthly payments.

High debt ratio has an impact on credit scores

The ratio of debt to credit is one of the key factors that determines a person’s credit score. The lower your debt-to-credit ratio, the better. The ideal ratio is less than 10%. You want to keep it below 30 percent. It doesn't necessarily mean that you shouldn't responsibly use credit. However, a high ratio may indicate that your finances aren't being managed properly.

Credit scoring also considers how credit-worthy you are. This ratio is determined by the amount of credit available to you. Your score will be affected if your debt-to credit ratio is high. This means that you should not max out your credit cards. To maintain a good credit rating, it is best to have a low utilization ratio and a low amount of debt-to-credit.

It can be reduced in several ways

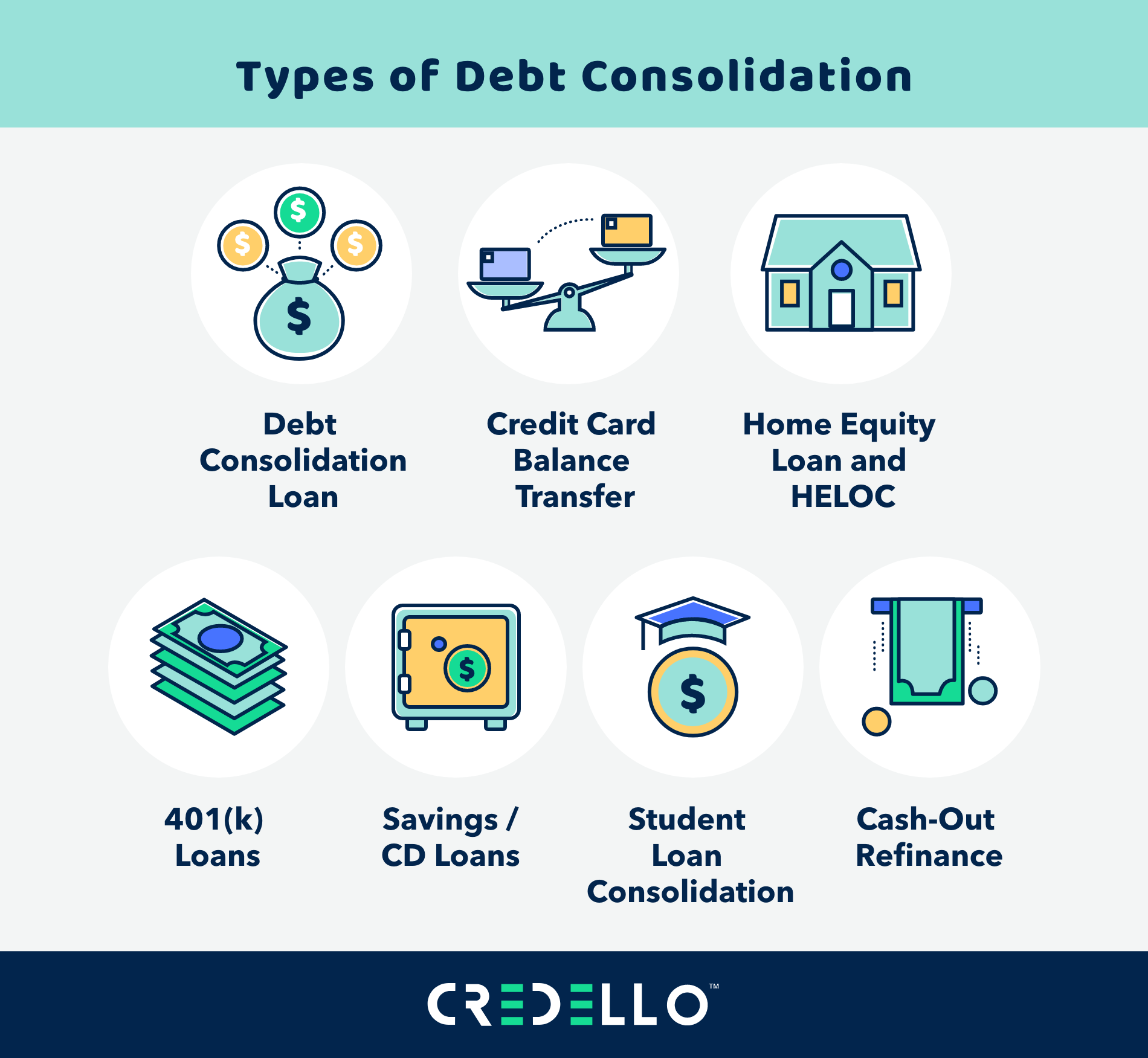

There are many methods to reduce your credit debt ratio (DTI), as well as credit score. It is important to not take on more debt. Your DTI will only increase if you have more debt. To avoid this problem, apply for only what you need. A debt snowball calculator can help you determine which debts will be easiest to pay. For a reduced amount of debt, debt consolidation is also an option.

You can also increase your income. While a high debt-to-income ratio might make sense if you're aggressively paying off your debt, it's not healthy if you're only making minimum payments. A good way to increase your income is to get an additional job, ask for a raise, or start a part-time business. These are all ways to increase your income while reducing your monthly payments.

FAQ

How to build a passive stream of income?

To earn consistent earnings from the same source, it is important to understand why people make purchases.

That means understanding their needs and wants. It is important to learn how to communicate with people and to sell to them.

Next, you need to know how to convert leads to sales. The final step is to master customer service in order to keep happy clients.

This is something you may not realize, but every product or service needs a buyer. If you know the buyer, you can build your entire business around him/her.

To become a millionaire it takes a lot. It takes even more to become billionaire. Why? You must first become a thousandaire in order to be a millionaire.

Finally, you can become a millionaire. The final step is to become a millionaire. The same applies to becoming a millionaire.

How does one become billionaire? It starts with being a millionaire. You only need to begin making money in order to reach this goal.

You have to get going before you can start earning money. Let's now talk about how you can get started.

What is the easiest passive income?

There are many ways to make money online. Most of them take more time and effort than what you might expect. So how do you create an easy way for yourself to earn extra cash?

You need to find what you love. You can then monetize your passion.

For example, let's say you enjoy creating blog posts. Create a blog to share useful information on niche-related topics. When readers click on the links in those articles, they can sign up for your emails or follow you via social media.

Affiliate marketing is a term that can be used to describe it. There are many resources available to help you get started. Here's a collection of 101 affiliate marketing tips & resources.

A blog could be another way to make passive income. Again, you will need to find a topic which you love teaching. However, once your site is established, you can make it more profitable by offering ebooks, videos and courses.

There are many ways to make money online, but the best ones are usually the simplest. Make sure you focus your efforts on creating useful websites and blogs if you truly want to make a living online.

Once you've built your website, promote it through social media sites like Facebook, Twitter, LinkedIn, Pinterest, Instagram, YouTube and more. This is content marketing. It's an excellent way to bring traffic back to your website.

How much debt is too much?

There is no such thing as too much cash. You will eventually run out money if you spend more than your income. Because savings take time to grow, it is best to limit your spending. When you run out of money, reduce your spending.

But how much do you consider too much? Although there's no exact number that will work for everyone, it is a good rule to aim to live within 10%. You won't run out of money even after years spent saving.

This means that you shouldn't spend more money than $10,000 a year if your income is $10,000. If you make $20,000, you should' t spend more than $2,000 per month. You shouldn't spend more that $5,000 per month if your monthly income is $50,000

This is where the key is to pay off all debts as quickly and easily as possible. This includes credit card bills, student loans, car payments, etc. Once those are paid off, you'll have extra money left over to save.

You should also consider whether you would like to invest any surplus income. You could lose your money if you invest in stocks or bonds. If you save your money, interest will compound over time.

Consider, for example: $100 per week is a savings goal. It would add up towards $500 over five-years. In six years you'd have $1000 saved. You'd have almost $3,000 in savings by the end of eight years. When you turn ten, you will have almost $13,000 in savings.

At the end of 15 years, you'll have nearly $40,000 in savings. That's quite impressive. If you had made the same investment in the stock markets during the same time, you would have earned interest. Instead of $40,000, you'd now have more than $57,000.

It is important to know how to manage your money effectively. You might end up with more money than you expected.

How do rich people make passive income?

There are two ways you can make money online. You can create amazing products and services that people love. This is what we call "earning money".

A second option is to find a way of providing value to others without creating products. This is what we call "passive" or passive income.

Let's imagine you own an App Company. Your job involves developing apps. But instead of selling them directly to users, you decide to give them away for free. That's a great business model because now you don't depend on paying users. Instead, you rely upon advertising revenue.

You might charge your customers monthly fees to help you sustain yourself as you build your business.

This is the way that most internet entrepreneurs are able to make a living. They give value to others rather than making stuff.

What is the best way for a side business to make money?

If you want to make money quickly, it's not enough to create a product or a service that solves an individual's problem.

You need to be able to make yourself an authority in any niche you choose. It means building a name online and offline.

Helping others solve problems is the best way to establish a reputation. So you need to ask yourself how you can contribute value to the community.

Once you answer that question you'll be able instantly to pinpoint the areas you're most suitable to address. There are many ways to make money online.

However, if you look closely you'll see two major side hustles. One involves selling products directly to customers and the other is offering consulting services.

Each approach has its pros and cons. Selling products and services provides instant gratification because once you ship your product or deliver your service, you receive payment right away.

The flip side is that you won't be able achieve the level you desire without building relationships and trust with potential clients. In addition, the competition for these kinds of gigs is fierce.

Consulting helps you grow your company without worrying about shipping goods or providing service. It takes more time to become an expert in your field.

In order to succeed at either option, you need to learn how to identify the right clientele. It takes some trial and error. However, the end result is worth it.

How can a beginner make passive income?

Begin with the basics. Next, learn how you can create value for yourself and then look at ways to make money.

You might even already have some ideas. If you do, great! You're great!

Find a job that suits your skills and interests to make money online.

For example, if you love creating websites and apps, there are plenty of opportunities to help you generate revenue while you sleep.

Reviewing products is a great way to express your creativity. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever you decide to focus on, make sure you choose something that you enjoy. You'll be more likely to stick with it over the long-term.

Once you've found a product or service you'd enjoy helping others buy, you'll need to figure out how to monetize it.

You have two options. One is to charge a flat rate for your services (like a freelancer), and the second is to charge per project (like an agency).

In both cases, once you have set your rates you need to make them known. This can be done via social media, emailing, flyers, or posting them to your list.

These three tips will help you increase your chances for success when marketing your business.

-

You are a professional. When you work in marketing, act like one. You never know who could be reading and evaluating your content.

-

Know what your topic is before you discuss it. No one wants to be a fake expert.

-

Emailing everyone in your list is not spam. If someone asks for a recommendation, send it directly to them.

-

Make sure to choose a quality email provider. Yahoo Mail, Gmail, and Yahoo Mail are both free.

-

Monitor your results. Track who opens your messages, clicks on links, and signs up for your mailing lists.

-

Your ROI can be measured by measuring how many leads each campaign generates and which campaigns convert the most.

-

Get feedback - Ask your friends and family if they are interested in your services and get their honest feedback.

-

Try different strategies - you may find that some work better than others.

-

You must continue learning and remain relevant in marketing.

Statistics

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

External Links

How To

How to make money when you're sleeping

Online success requires that you learn to sleep well while awake. This means that you must be able to do more than simply wait for someone click on your link to buy your product. Making money at night is essential.

You will need to develop an automated system that generates income without having to touch a single button. To do that, you must master the art of automation.

You would benefit from becoming an expert at developing software systems that perform tasks automatically. So you can concentrate on making money while sleeping. You can even automate yourself out of a job.

You can find these opportunities by creating a list of daily problems. Ask yourself if you can automate these problems.

Once you have done this, you will likely realize that there are many ways you can generate passive income. Now, it's time to find the most lucrative.

If you're a webmaster, you might be able to create a website creator that automates the creation and maintenance of websites. You might also be able to create templates for logo production that you can use in an automated way if you're a graphic designer.

You could also create software programs that allow you to manage multiple clients at once if your business is established. There are hundreds of possibilities.

Automating anything is possible as long as your creativity can solve a problem. Automation is key to financial freedom.