Upstart loans can be a loan option that uses artificial Intelligence to help you find a better deal. The company claims that its process will allow you to receive a credit offer from multiple lenders, instead of just one, which will decrease the risk for both lender and consumer. It also provides flexible payment options. You can pick when you pay, which is very helpful for credit builders. Upstart also allows you to see your payments online.

You will need to complete an application before you can apply for an Upstart loan. This will include basic information like your income and education, as well your employment history and address. Generally, applicants can receive a loan amount based on their credit score and other factors. It is important to remember that not all applicants will be eligible for an Upstart loan. Some people may not be approved for loans if they have recent bankruptcy filings or public records. You will need to improve your credit score if you have been denied for a loan in the past.

Upstart provides loans to people with poor, average or good credit. They also offer various types of loans such as car refinances and small business loans. The company is not a bank but is accredited by Better Business Bureau (BBB). It has an A+ rating.

Personal loans from Upstart come with an origination charge of 0% to 8.8% depending on the loan amount. For past due payments, you will also be required to pay a late fee of 5%. Upstart will conduct a credit check on you once you have submitted your application. Because this is a difficult inquiry, it may temporarily lower your credit score. You will also need to pay $10 to convert your paper records to electronic ones.

It is easy to get approved for an Upstart loan. After you have registered, an initial rate proposal will be sent to you. Next, enter the purpose of the funds. A physical copy will be sent to you with the loan agreement. You can also schedule payment dates for the future, though you'll need to track them down.

Upstart offers educational materials and other resources. You can get financial advice and learn more about how to manage your money, and you can see your payment obligations online. You won't need a payment app, or phone service, to monitor your repayments unlike other lending sites.

Younger people are able to get credit with Upstart. It doesn't depend on traditional credit scores and approves more borrowers that banks. The AI-based underwriting process allows for easier loan approvals, since it takes into account a variety of factors including employment history and education. However, it has higher interest rates than many of its competition.

Some customers have had problems with their application and customer service. Despite having an A+ rating at the BBB, the company received a No-action Letter from the Consumer Financial Protection Bureau. And, according to Trustpilot, the majority of reviews are positive.

FAQ

Which passive income is easiest?

There are many online ways to make money. Many of these methods require more work and time than you might be able to spare. How can you make extra cash easily?

Find something that you are passionate about, whether it's writing, design, selling, marketing, or blogging. Find a way to monetize this passion.

For example, let's say you enjoy creating blog posts. Make a blog and share information on subjects that are relevant to your niche. Then, when readers click on links within those articles, sign them up for emails or follow you on social media sites.

This is called affiliate marketing. You can find plenty of resources online to help you start. Here's a list with 101 tips and resources for affiliate marketing.

You could also consider starting a blog as another form of passive income. It's important to choose a topic you are passionate about. However, once your site is established, you can make it more profitable by offering ebooks, videos and courses.

There are many ways to make money online, but the best ones are usually the simplest. You can make money online by building websites and blogs that offer useful information.

Once your website is built, you can promote it via social media sites such as Facebook, Twitter, LinkedIn and Pinterest. This is content marketing. It's an excellent way to bring traffic back to your website.

How can a beginner make passive money?

Begin with the basics. Once you have learned how to create value, then move on to finding ways to make more money.

You might even have some ideas. If you do, great! If you do, great!

The best way to earn money online is to look for an opportunity matching your skillset and interests.

If you are passionate about creating apps and websites, you can find many opportunities to generate revenue while you're sleeping.

Reviewing products is a great way to express your creativity. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever topic you choose to focus on, ensure that it's something you enjoy. You'll be more likely to stick with it over the long-term.

Once you've found a product or service you'd enjoy helping others buy, you'll need to figure out how to monetize it.

This can be done in two ways. You can either charge a flat fee (like a freelancer) or you can charge per project (like an agent).

Either way, once you have established your rates, it's time to market them. This can be done via social media, emailing, flyers, or posting them to your list.

To increase your chances of success, keep these three tips in mind when promoting your business:

-

When marketing, be a professional. It is impossible to predict who might be reading your content.

-

Know what your topic is before you discuss it. False experts are unattractive.

-

Avoid spamming - unless someone specifically requests information, don't email everyone in your contact list. If someone asks for a recommendation, send it directly to them.

-

Make sure to choose a quality email provider. Yahoo Mail, Gmail, and Yahoo Mail are both free.

-

Monitor your results. Track who opens your messages, clicks on links, and signs up for your mailing lists.

-

Measuring your ROI is a way to determine which campaigns have the highest conversions.

-

Get feedback - ask friends and family whether they would be interested in your services, and get their honest feedback.

-

Test different tactics - try multiple strategies to see which ones work better.

-

Continue to learn - keep learning so that you remain relevant as a marketer.

Which side hustles are the most lucrative in 2022

The best way to make money today is to create value for someone else. If you do this well the money will follow.

Even though you may not realise it right now, you have been creating value since the beginning. Your mommy gave you life when you were a baby. The best place to live was the one you created when you learned to walk.

You'll continue to make more if you give back to the people around you. You'll actually get more if you give more.

Value creation is a powerful force that everyone uses every day without even knowing it. You're creating value all day long, whether you're making dinner for your family or taking your children to school.

Today, Earth is home for nearly 7 million people. That means that each person is creating a staggering amount of value daily. Even if you only create $1 worth of value per hour, you'd be creating $7 million dollars a year.

This means that you would earn $700,000.000 more a year if you could find ten different ways to add $100 each week to someone's lives. Imagine that you'd be earning more than you do now working full time.

Now let's pretend you wanted that to be doubled. Let's imagine you could find 20 ways of adding $200 per month to someone's lives. Not only would you make an additional $14.4million dollars per year, but you'd also become extremely wealthy.

Every single day, there are millions more opportunities to create value. This includes selling ideas, products, or information.

Although many of us spend our time thinking about careers and income streams, these tools are only tools that enable us to reach our goals. Ultimately, the real goal is to help others achieve theirs.

Create value to make it easier for yourself and others. Use my guide How to create value and get paid for it.

What is the difference in passive income and active income?

Passive income refers to making money while not working. Active income is earned through hard work and effort.

Your active income comes from creating value for someone else. When you earn money because you provide a service or product that someone wants. For example, selling products online, writing an ebook, creating a website, advertising your business, etc.

Passive income can be a great option because you can put your efforts into more important things and still make money. Most people don't want to work for themselves. So they choose to invest time and energy into earning passive income.

The problem is that passive income doesn't last forever. If you wait too long before you start to earn passive income, it's possible that you will run out.

Also, you could burn out if passive income is not generated in a timely manner. You should start immediately. If you wait too long to begin building passive income you will likely miss out on potential opportunities to maximize earnings.

There are three types to passive income streams.

-

These include starting a business, owning a franchise or becoming a freelancer. You could also rent the property, such as real-estate, to other people.

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real Estate includes flipping houses, purchasing land and renting properties.

What is the fastest way you can make money in a side job?

If you want money fast, you will need to do more than simply create a product/service to solve a problem.

Also, you need to figure out a way that will position yourself as an authority on any niche you choose. It's important to have a strong online reputation.

Helping other people solve their problems is the best way for a person to earn a good reputation. So you need to ask yourself how you can contribute value to the community.

After answering that question, it's easy to identify the areas in which you are most qualified to work. There are many online ways to make money, but they are often very competitive.

But when you look closely, you can see two main side hustles. One type involves selling products and services directly to customers, while the other involves offering consulting services.

Each approach has its pros and cons. Selling products and services can provide instant gratification since once you ship the product or deliver the service, payment is received immediately.

You might not be able to achieve the success you want if you don't spend enough time building relationships with potential clients. Additionally, there is intense competition for these types of gigs.

Consulting can help you grow your business without having to worry about shipping products and providing services. However, it takes time to become an expert on your subject.

You must learn to identify the right clients in order to be successful at each option. This requires a little bit of trial and error. It pays off in the end.

How much debt is considered excessive?

It's essential to keep in mind that there is such a thing as too much money. You will eventually run out money if you spend more than your income. Because savings take time to grow, it is best to limit your spending. If you are running out of funds, cut back on your spending.

But how much can you afford? There isn't an exact number that applies to everyone, but the general rule is that you should aim to live within 10% of your income. You'll never go broke, even after years and years of saving.

If you earn $10,000 per year, this means you should not spend more than $1,000 per month. If you make $20,000, you should' t spend more than $2,000 per month. And if you make $50,000, you shouldn't spend more than $5,000 per month.

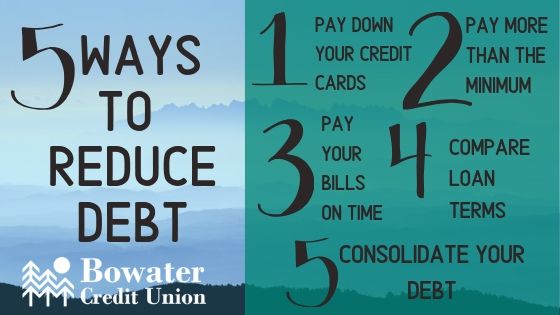

The key here is to pay off debts as quickly as possible. This includes student loans and credit card bills. You'll be able to save more money once these are paid off.

You should also consider whether you would like to invest any surplus income. You could lose your money if you invest in stocks or bonds. But if you choose to put it into a savings account, you can expect interest to compound over time.

For example, let's say you set aside $100 weekly for savings. It would add up towards $500 over five-years. In six years you'd have $1000 saved. In eight years, your savings would be close to $3,000 By the time you reach ten years, you'd have nearly $13,000 in savings.

At the end of 15 years, you'll have nearly $40,000 in savings. That's pretty impressive. However, this amount would have earned you interest if it had been invested in stock market during the exact same period. Instead of $40,000 you would now have $57,000.

That's why it's important to learn how to manage your finances wisely. You might end up with more money than you expected.

Statistics

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

External Links

How To

How passive income can improve cash flow

You don't have to work hard to make money online. Instead, there are ways for you to make passive income from home.

Automation could also be beneficial for an existing business. If you are considering starting your own business, automating parts can help you save money and increase productivity.

Automating your business is a great way to increase its efficiency. This will enable you to devote more time to growing your business instead of running it.

Outsourcing tasks is a great method to automate them. Outsourcing lets you focus on the most important aspects of your business. When you outsource a task, it is effectively delegating the responsibility to another person.

This means that you can focus on the important aspects of your business while allowing someone else to manage the details. Outsourcing allows you to focus on the important aspects of your business and not worry about the little things.

Another option is to turn your hobby into a side hustle. You can also use your talents to create an online product or service. This will help you generate additional cash flow.

For example, if you enjoy writing, why not write articles? You have many options for publishing your articles. These sites pay per article and allow you to make extra cash monthly.

Making videos is also possible. Many platforms allow you to upload videos to YouTube or Vimeo. These videos will bring traffic to your site and social media pages.

One last way to make money is to invest in stocks and shares. Investing in shares and stocks is similar to investing real estate. Instead of receiving rent, dividends are earned.

They are included in your dividend when shares you buy are purchased. The amount of your dividend will depend on how much stock is purchased.

You can reinvest your profits in buying more shares if you decide to sell your shares. This way you'll continue to be paid dividends.