Before making a decision on a debt consolidation strategy, you need to take into account several factors. These factors include timeliness, effectiveness, impact on credit scores, and how it will affect your credit score. Debt consolidation is an excellent option for many people, so you should research it thoroughly before making the decision to consolidate your debts.

Effectiveness of debt consolidation

Debt consolidation is a great way to improve your credit, but there are some risks to consider. There are potential for loan terms and amounts to increase. You may not receive the best interest rate. It is important to consider your immediate needs and long-term goals before making any decision. For people with bad credit, debt consolidation might not be the best choice.

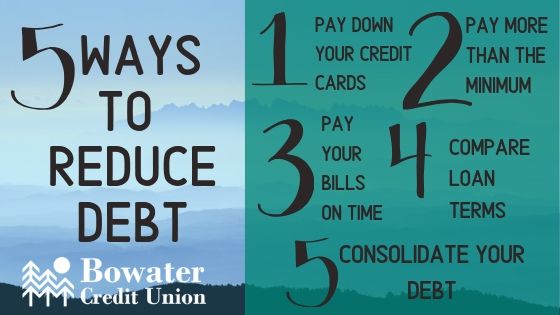

The first benefit of debt consolidation is that it can help you pay off your debt faster. You need to prioritize which debts are to be paid off first. High interest debts should be paid off first. If you feel stressed, you may choose to pay it off first.

One benefit to debt consolidation is that you can only make one monthly payment and not multiple. This will allow you to make your debt payments more manageable and pay it off faster. You can also save money over the long-term by lowering your interest rates on your debt consolidation loan.

Credit Score Impact

You might wonder how consolidating your debts affects your credit score. Consolidating your debts won't negatively impact your credit score. In fact, the process is good for improving your financial situation. It will also result in lower interest rates, which will help you pay off your debts faster.

Although debt consolidation can improve your credit score, it is important to realize that it will also impact your debt-to–credit ratio. This ratio accounts for approximately 30 percent of your overall credit score. A credit score that has a lower ratio is more positive. A high ratio can lead to financial problems.

According to a recent study conducted by TransUnion, consumers who chose to consolidate their debts had better credit performance than consumers who had accumulated a large amount of debt. 68% of those surveyed saw their credit score improve by more than 20 percentage points. This improvement was consistent across all risk categories, with the highest number of improvements occurring in the prime and below risk categories. Further, the initial boost to credit scores was visible in one quarter and lasted up to a year later.

Timing of payments

A debt consolidation program can help with your budgeting, help eliminate fluctuating interest rates, and allow you to pay off your loan on a regular basis. This can help you expand your financial options, including buying a property. However, you must make sure to make your payments on time to avoid having your loan default. Find out more about debt consolidation. You can also consolidate debt to qualify for a mortgage.

FAQ

What is the fastest way you can make money in a side job?

To make money quickly, you must do more than just create a product/service that solves a problem.

You must also find a way of establishing yourself as an authority in any niche that you choose. That means building a reputation online as well as offline.

The best way to build a reputation is to help others solve problems. Consider how you can bring value to the community.

Once you've answered the question, you can immediately identify which areas of your expertise. There are many ways to make money online.

You will see two main side hustles if you pay attention. The first type is selling products and services directly, while the second involves offering consulting services.

Each method has its own pros and con. Selling products or services offers instant gratification, as once your product is shipped or your service is delivered, you will receive payment immediately.

But, on the other hand, you might not have the success you desire if you do not spend the time to build relationships with potential clientele. These gigs are also highly competitive.

Consulting allows you to grow and manage your business without the need to ship products or provide services. However, it takes time to become an expert on your subject.

To be successful in either field, you must know how to identify the right customers. It will take some trial-and-error. However, the end result is worth it.

What are the top side hustles that will make you money in 2022

To create value for another person is the best way to make today's money. If you do this well, the money will follow.

Although you may not be aware of it, you have been creating value from day one. You sucked your mommy’s breast milk as a baby and she gave life to you. Learning to walk gave you a better life.

Giving value to your friends and family will help you make more. The truth is that the more you give, you will receive more.

Everyone uses value creation every day, even though they don't know it. Whether you're cooking dinner for your family, driving your kids to school, taking out the trash, or simply paying the bills, you're constantly creating value.

In actuality, Earth is home to nearly 7 billion people right now. That means that each person is creating a staggering amount of value daily. Even if your hourly value is $1, you could create $7 million annually.

You could add $100 per week to someone's daily life if you found ten more. That would make you an additional $700,000 annually. This is a lot more than what you earn working full-time.

Now let's pretend you wanted that to be doubled. Let's say that you found 20 ways each month to add $200 to someone else's life. Not only would you earn another $14.4 million dollars annually, you'd also become incredibly wealthy.

Every single day, there are millions more opportunities to create value. This includes selling products, services, ideas, and information.

Even though we spend much of our time focused on jobs, careers, and income streams, these are merely tools that help us accomplish our goals. Helping others to achieve their goals is the ultimate goal.

Focus on creating value if you want to be successful. Start by downloading my free guide, How to Create Value and Get Paid for It.

Why is personal finances important?

Personal financial management is an essential skill for anyone who wants to succeed. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

So why should we wait to save money? What is the best thing to do with our time and energy?

Yes, and no. Yes because most people feel guilty about saving money. Because the more money you earn the greater the opportunities to invest.

If you can keep your eyes on what is bigger, you will always be able spend your money wisely.

To become financially successful, you need to learn to control your emotions. You won't be able to see the positive aspects of your situation and will have no support from others.

Your expectations regarding how much money you'll eventually accumulate may be unrealistic. This is because your financial management skills are not up to par.

Once you've mastered these skills, you'll be ready to tackle the next step - learning how to budget.

Budgeting is the act of setting aside a portion of your income each month towards future expenses. You can plan ahead to avoid impulse purchases and have sufficient funds for your bills.

Now that you are able to effectively allocate your resources, you can look forward to a brighter future.

What is the difference in passive income and active income?

Passive income is when you earn money without doing any work. Active income is earned through hard work and effort.

If you are able to create value for somebody else, then that's called active income. If you provide a service or product that someone is interested in, you can earn money. For example, selling products online, writing an ebook, creating a website, advertising your business, etc.

Passive income allows you to be more productive while making money. However, most people don't like working for themselves. Therefore, they opt to earn passive income by putting their efforts and time into it.

The problem is that passive income doesn't last forever. If you hold off too long in generating passive income, you may run out of cash.

Also, you could burn out if passive income is not generated in a timely manner. It is best to get started right away. If you wait too long to begin building passive income you will likely miss out on potential opportunities to maximize earnings.

There are three types or passive income streams.

-

There are many options for businesses: You can own a franchise, start a blog, become a freelancer or rent out real estate.

-

These include stocks and bonds and mutual funds. ETFs are also investments.

-

Real Estate - These include buying land, flipping houses and investing in real estate.

How to create a passive income stream

To consistently earn from one source, you need to understand why people buy what is purchased.

This means that you must understand their wants and needs. You need to know how to connect and sell to people.

You must then figure out how you can convert leads into customers. To keep clients happy, you must be proficient in customer service.

You may not realize this, but every product or service has a buyer. Knowing who your buyer is will allow you to design your entire company around them.

A lot of work is required to become a millionaire. To become a billionaire, it takes more effort. Why? To become a millionaire you must first be a thousandaire.

Finally, you can become a millionaire. You can also become a billionaire. The same is true for becoming billionaire.

How does one become a billionaire, you ask? It starts by being a millionaire. All you have to do in order achieve this is to make money.

You have to get going before you can start earning money. Let's take a look at how we can get started.

Which side hustles are most lucrative?

Side hustles are income streams that add to your primary source of income.

Side hustles are important because they make it possible to earn extra money for fun activities as well as bills.

Side hustles may also allow you to save more money for retirement and give you more flexibility in your work schedule. They can even help you increase your earning potential.

There are two types. Online businesses, such as blogs, ecommerce stores and freelancing, are passive side hustles. Some of the active side hustles are tutoring, dog walking and selling eBay items.

Side hustles that are right for you fit in your daily life. Consider starting a business in fitness if your passion is working out. If you love to spend time outdoors, consider becoming an independent landscaper.

There are many side hustles that you can do. Consider side hustles where you spend your time already, such as volunteering or teaching classes.

For example, if you have experience in graphic design, why not open your own graphic design studio? Or perhaps you have skills in writing, so why not become a ghostwriter?

Be sure to research thoroughly before you start any side hustle. When the opportunity presents itself, be prepared to jump in and seize it.

Side hustles are not just about making money. They can help you build wealth and create freedom.

With so many options to make money, there is no reason to stop starting one.

Statistics

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

External Links

How To

How to Make Money While You Are Asleep

You must be able to fall asleep while you're awake if you want to make it big online. This means that you must be able to do more than simply wait for someone click on your link to buy your product. Make money while you're sleeping.

This requires you to create an automated system that makes money without you having to lift a finger. Automating is the key to success.

It would be helpful if you could become an expert at creating software systems that automatically perform tasks. You can then focus on making money, even while you're sleeping. You can automate your job.

You can find these opportunities by creating a list of daily problems. Next, ask yourself if there are any ways you could automate them.

Once you do that, you will probably find that there are many other ways to make passive income. The next step is to determine which option would be most lucrative.

Perhaps you can create a website building tool that automates web design if, for example, you are a webmaster. Maybe you are a webmaster and a graphic designer. You could also create templates that could be used to automate production of logos.

A software program could be created if you are an entrepreneur to allow you to manage multiple customers simultaneously. There are hundreds of options.

Automating anything is possible as long as your creativity can solve a problem. Automation is the key to financial freedom.