Medical bills can quickly mount up and become a major debt. There are options to get out of debt and still have access to medical treatment.

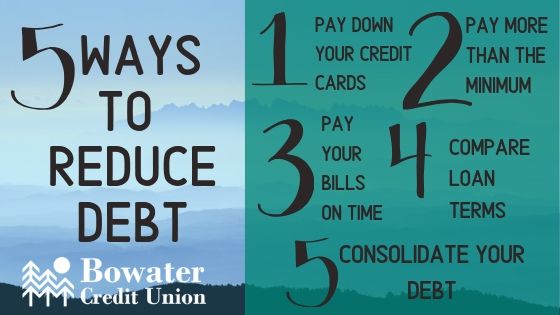

First, you should determine if the medical debts you're dealing with can be consolidated. By working with doctors, hospitals and insurance companies, a medical consolidation program could reduce your monthly payments or interest.

Consider hiring a professional for help with managing your debt. These companies can help you save time and reduce stress when dealing with debt collectors and billing departments. These companies can also negotiate for you and have different strategies for dealing with medical debts.

Third, you can try a debt consolidation loan that will pay off your existing medical debts and give you a single payment to make each month. This consolidation has a higher rate of interest than paying medical bills directly to providers. But it is an option that some consumers may find appealing.

You can also use a low-interest credit card that offers a zero or low interest introductory period to consolidate medical debt. This will only work for you if you are confident that you can pay the full amount in that first period.

Consider a personal loans to consolidate your medical expenses. You can obtain a loan through a bank or credit union. This will allow you consolidate all medical bills on a single credit cards with lower rates of interest than any other debt.

It is important to note that not paying your medical debts will affect your credit rating. It is best to consolidate your medical bills if you do not have a high amount of debt.

Another alternative to medical debt consolidation is to contact a nonprofit credit counseling agency. Counselors are able to evaluate your debts, income and expenses and suggest debt relief solutions.

Alternatively, you can negotiate with your creditors to settle your medical bills for less than what you owe. It will take you longer to repay this debt than credit cards. However, it is an effective solution to your financial issues.

If you don't have the savings to cover your medical expenses and have a high ratio of debts to income, consolidating your debts is an excellent option. You'll save money in interest fees and be able to pay a monthly amount that is within your budget.

Remember that medical debt may be harder to get rid of than other unsecured consumer debt. In fact, it can appear on your credit history for as long as seven years. A large medical debt can make it hard to qualify or get a new auto, credit card, or mortgage. This can also impact your ability to buy or rent an apartment.

FAQ

Why is personal financial planning important?

A key skill to any success is personal financial management. Our world is characterized by tight budgets and difficult decisions about how to spend it.

So why do we put off saving money? Is there nothing better to spend our time and energy on?

Yes and no. Yes, because most people feel guilty when they save money. It's not true, as more money means more opportunities to invest.

Spending your money wisely will be possible as long as you remain focused on the larger picture.

You must learn to control your emotions in order to be financially successful. You won't be able to see the positive aspects of your situation and will have no support from others.

You may also have unrealistic expectations about how much money you will eventually accumulate. This is because you haven't learned how to manage your finances properly.

Once you've mastered these skills, you'll be ready to tackle the next step - learning how to budget.

Budgeting is the act or practice of setting aside money each month to pay for future expenses. You can plan ahead to avoid impulse purchases and have sufficient funds for your bills.

So now that you know how to allocate your resources effectively, you can begin to look forward to a brighter financial future.

How to build a passive income stream?

To earn consistent earnings from the same source, it is important to understand why people make purchases.

That means understanding their needs and wants. This requires you to be able connect with people and make sales to them.

Then you have to figure out how to convert leads into sales. To retain happy customers, you need to be able to provide excellent customer service.

Even though it may seem counterintuitive, every product or service has its buyer. And if you know who that buyer is, you can design your entire business around serving him/her.

To become a millionaire it takes a lot. It takes even more to become billionaire. Why? To become a millionaire you must first be a thousandaire.

Then you must become a millionaire. Finally, you can become a multi-billionaire. The same applies to becoming a millionaire.

How does one become billionaire? It starts with being a millionaire. All you need to do to achieve this is to start making money.

But before you can begin earning money, you have to get started. Let's look at how to get going.

Which side hustles are the most lucrative in 2022

The best way to make money today is to create value for someone else. If you do this well, the money will follow.

While you might not know it, your contribution to the world has been there since day one. Your mommy gave you life when you were a baby. When you learned how to walk, you gave yourself a better place to live.

Giving value to your friends and family will help you make more. You'll actually get more if you give more.

Value creation is a powerful force that everyone uses every day without even knowing it. It doesn't matter if you're cooking dinner or driving your kids to school.

In reality, Earth has nearly 7 Billion people. This means that every person creates a tremendous amount of value each day. Even if only one hour is spent creating value, you can create $7 million per year.

That means that if you could find ten ways to add $100 to someone's life per week, you'd earn an extra $700,000 a year. Think about that - you would be earning far more than you currently do working full-time.

Now let's pretend you wanted that to be doubled. Let's say you found 20 ways to add $200 to someone's life per month. You would not only be able to make $14.4 million more annually, but also you'd become very wealthy.

There are millions of opportunities to create value every single day. Selling products, services and ideas is one example.

Although we tend to spend a lot of time focusing on our careers and income streams, they are just tools that allow us to achieve our goals. Ultimately, the real goal is to help others achieve theirs.

If you want to get ahead, then focus on creating value. You can start by using my free guide: How To Create Value And Get Paid For It.

Is there a way to make quick money with a side hustle?

To make money quickly, you must do more than just create a product/service that solves a problem.

You must also find a way of establishing yourself as an authority in any niche that you choose. It means building a name online and offline.

Helping other people solve their problems is the best way for a person to earn a good reputation. It is important to consider how you can help the community.

Once you've answered that question, you'll immediately be able to figure out which areas you'd be most suited to tackle. There are many online ways to make money, but they are often very competitive.

However, if you look closely you'll see two major side hustles. One involves selling products directly to customers and the other is offering consulting services.

Each approach has its advantages and disadvantages. Selling products or services offers instant gratification, as once your product is shipped or your service is delivered, you will receive payment immediately.

On the flip side, you might not reach the level of success you desire unless you spend time developing relationships with potential clients. In addition, the competition for these kinds of gigs is fierce.

Consulting can help you grow your business without having to worry about shipping products and providing services. However, it can take longer to be recognized as an expert in your area.

You must learn to identify the right clients in order to be successful at each option. This takes some trial and errors. But it will pay off big in the long term.

Which passive income is easiest?

There are tons of ways to make money online. Many of these methods require more work and time than you might be able to spare. How can you make extra cash easily?

The answer is to find something you love, whether blogging, writing, designing, selling, marketing, etc. That passion can be monetized.

For example, let's say you enjoy creating blog posts. Your blog will provide useful information on topics relevant to your niche. When readers click on those links, sign them up to your email list or follow you on social networks.

This is called affiliate marketing, and there are plenty of resources to help you get started. Here are 101 affiliate marketing tips and resources.

As another source of passive income, you might also consider starting your own blog. You'll need to choose a topic that you are passionate about teaching. After you've created your website, you can start offering ebooks and courses to make money.

There are many ways to make money online, but the best ones are usually the simplest. It is important to focus on creating websites and blogs that provide valuable information if your goal is to make money online.

Once you've built your website, promote it through social media sites like Facebook, Twitter, LinkedIn, Pinterest, Instagram, YouTube and more. This is called content marketing, and it's a great method to drive traffic to your website.

What is the difference in passive income and active income?

Passive income can be defined as a way to make passive income without any work. Active income requires work and effort.

You create value for another person and earn active income. It is when someone buys a product or service you have created. For example, selling products online, writing an ebook, creating a website, advertising your business, etc.

Passive income allows you to be more productive while making money. But most people aren't interested in working for themselves. They choose to make passive income and invest their time and energy.

The problem is that passive income doesn't last forever. If you are not quick enough to start generating passive income you could run out.

You also run the risk of burning out if you spend too much time trying to generate passive income. Start now. You'll miss out on the best opportunities to maximize your earning potential if you wait to build passive income.

There are three types passive income streams.

-

There are several options available for business owners: you can start a company, buy a franchise and become a freelancer. Or rent out your property.

-

Investments include stocks, bonds, mutual funds, ETFs, and ETFs.

-

Real Estate - These include buying land, flipping houses and investing in real estate.

Statistics

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

External Links

How To

Get passive income ideas to increase cash flow

There are ways to make money online without having to do any hard work. Instead, there are passive income options that you can use from home.

There may be an existing business that could use automation. Automating parts of your business workflow could help you save time, increase productivity, and even make it easier to start one.

Automating your business is a great way to increase its efficiency. This means you will be able to spend more time working on growing your business rather than running it.

Outsourcing tasks is an excellent way to automate them. Outsourcing lets you focus on the most important aspects of your business. By outsourcing a task you effectively delegate it to another party.

This means that you can focus on the important aspects of your business while allowing someone else to manage the details. Because you don't have to worry so much about the details, outsourcing makes it easier for your business to grow.

You can also turn your hobby into an income stream by starting a side business. A side hustle is another option to generate additional income.

For example, if you enjoy writing, why not write articles? You have many options for publishing your articles. These websites pay per article, allowing you to earn extra monthly cash.

Also, you can create videos. Many platforms allow you to upload videos to YouTube or Vimeo. These videos can drive traffic to your website or social media pages.

Another way to make extra money is to invest your capital in shares and stocks. Stocks and shares are similar to real estate investments. You are instead paid rent. Instead, you receive dividends.

As part of your payout, shares you have purchased are given to shareholders. The size of the dividend you receive will depend on how many stocks you purchase.

You can sell shares later and reinvest the profits into more shares. You will still receive dividends.