Consolidating your debts is when you take out a large loan to consolidate multiple debts. This can cause credit risk, especially if the payment requirements are not met. Talk to your lenders to negotiate a lower interest rate or a longer repayment period. Before you make a final decision, ensure that you fully understand the process.

Personal loans

Personal loans can be used to consolidate your debts. Before you apply for a personal loans, there are a few things you should know. First, your credit score is important. Your credit score can be affected by high debt and late payments. Credit scores will improve if all payments are made on time. You should also avoid opening new credit cards if consolidating your debts. It will not only make it difficult to make your monthly payments on the new loan, but it could also cause damage to your credit score.

Your credit score can be improved to get a lower interest loan rate. This will help you save money over the term of your loan. You should shop around to find the best interest rate and make sure you focus on lenders that offer prequalification.

Home equity line of credit

Home equity lines are a way to borrow against the equity in your house. Equity is simply the difference between the home's value and the amount owed on your mortgage. Bank of America allows you to borrow upto 85% of the home's value.

The requirements for equity loans as well as lines of credit are strict. Lenders do NOT want to lose their money in foreclosure. Therefore, they assess your credit score, income, and any other financial information to determine the risk of defaulting. They also assess credit and other debts. Good credit is a better indicator of your ability to obtain a loan for home equity.

Debt settlement programs

Debt settlement programs consolidate debts by negotiating with your creditors to lower the total amount you owe. These programs can lower your debt by between thirty and eighty percent. Additionally, you won't have monthly payments to your creditors. Instead, you will contribute towards a program savings account that eventually provides the funds necessary to settle your creditors.

It's not for everyone. It's only an option if your debt is so far past due that you're facing financial hardship. If you are able to pay the bills on time and willing to work with creditors, debt settlement may be an option. While debt settlement may be attractive, it's important to know that you'll be taking on significant risks. Negating with your creditors can cause damage to your credit score. You also run the risk that you will be sued or liable for taxes on any debts you settle.

Refinancing

Consolidating your debt with refinance is a great method to reduce interest rates while simplifying monthly payments. This is done by tapping into the equity of your home. This converts unsecured to secured debt. Your home will not be at risk should you default. It is also important to modify your spending habits to lower interest rates and your monthly payments. You must also have a reasonable debt-to-income ratio, which is calculated by taking your monthly debt payments and dividing them by your total monthly income.

An excellent credit score can help qualify you for higher interest rates. Reputable lenders can offer debt consolidation loans to help your finances. A lower interest rate may allow you to make a smaller monthly payment. This will give you more money for principal payments. You can also improve your credit score through debt consolidation by obtaining a better interest rate.

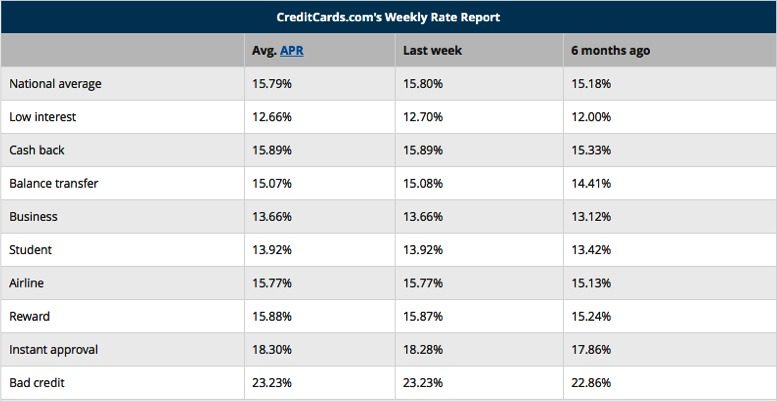

Transfer fees to balance

Consolidating debts can result in high balance transfer fees. These fees will vary depending upon the card issuer. You should compare them to other options. In general, you'll be charged between 3% - 5% of the amount you transfer. Credit card issuers sometimes offer no-fee promotions. To get the best rate, make the transfer as soon as possible after opening your account. The origination fee covers the cost of processing your application. When you shop around, it is possible to get a great deal without paying a lot of money for a balance transfer.

Some offers include 0% APR for a limited time. The regular rates start after this period. Even if credit is good, it is important to know about these fees. It's not difficult to see how expensive a credit cards can be. You are responsible for all fees associated with the card, including the interest rates. Not only are there late payment fees but also overlimit fees, check returns and balance transfer charges.

FAQ

How do wealthy people earn passive income through investing?

There are two methods to make money online. The first is to create great products or services that people love and will pay for. This is called "earning" money.

A second option is to find a way of providing value to others without creating products. This is what we call "passive" or passive income.

Let's imagine you own an App Company. Your job is to create apps. You decide to give away the apps instead of making them available to users. It's a great model, as it doesn't depend on users paying. Instead, you rely upon advertising revenue.

Customers may be charged monthly fees in order to sustain your business while you are building it.

This is how most successful internet entrepreneurs earn money today. They are more focused on providing value than creating stuff.

What side hustles make the most profit?

Side hustles can be described as any extra income stream that supplements your main source of income.

Side hustles are very important because they provide extra money for bills and fun activities.

Side hustles may also allow you to save more money for retirement and give you more flexibility in your work schedule. They can even help you increase your earning potential.

There are two types side hustles: active and passive. Online side hustles can be passive or active. These include ecommerce shops, blogging and freelancing. Active side hustles include jobs such as dog walking, tutoring, and selling items on eBay.

Side hustles that make sense and work well with your lifestyle are the best. Consider starting a business in fitness if your passion is working out. You might consider working as a freelance landscaper if you love spending time outdoors.

Side hustles are available anywhere. You can find side hustles anywhere.

For example, if you have experience in graphic design, why not open your own graphic design studio? Perhaps you're an experienced writer so why not go ghostwriting?

You should do extensive research and planning before you begin any side hustle. So when an opportunity presents itself, you will be prepared to take it.

Side hustles don't have to be about making money. They are about creating wealth, and freedom.

There are so many opportunities to make money that you don't have to give up, so why not get one?

What is the easiest way to make passive income?

There are tons of ways to make money online. Many of these methods require more work and time than you might be able to spare. How do you make extra cash easy?

You need to find what you love. and monetize that passion.

For example, let's say you enjoy creating blog posts. You can start a blog that shares useful information about topics in your niche. You can sign readers up for emails and social media by clicking on the links in the articles.

This is affiliate marketing. There are lots of resources that will help you get started. Here's a collection of 101 affiliate marketing tips & resources.

You might also think about starting a blog to earn passive income. Again, you will need to find a topic which you love teaching. After you've created your website, you can start offering ebooks and courses to make money.

There are many ways to make money online, but the best ones are usually the simplest. It is important to focus on creating websites and blogs that provide valuable information if your goal is to make money online.

Once you've created your website promote it through social media like Facebook, Twitter LinkedIn, Pinterest Instagram, YouTube, and many other sites. This is what's known as content marketing. It's a great way for you to drive traffic back your site.

Why is personal financing important?

Personal financial management is an essential skill for anyone who wants to succeed. We live in a world that is fraught with money and often face difficult decisions regarding how we spend our hard-earned money.

Why do we delay saving money? What is the best thing to do with our time and energy?

Both yes and no. Yes, because most people feel guilty when they save money. No, because the more money you earn, the more opportunities you have to invest.

If you can keep your eyes on what is bigger, you will always be able spend your money wisely.

Financial success requires you to manage your emotions. You won't be able to see the positive aspects of your situation and will have no support from others.

Unrealistic expectations may also be a factor in how much you will end up with. This could be because you don't know how your finances should be managed.

After mastering these skills, it's time to learn how to budget.

Budgeting refers to the practice of setting aside a portion each month for future expenses. Planning will help you avoid unnecessary purchases and make sure you have enough money to pay your bills.

You now have the knowledge to efficiently allocate your resources and can start to see a brighter financial future.

How can a beginner make passive income?

Begin with the basics. Next, learn how you can create value for yourself and then look at ways to make money.

You might even already have some ideas. If you do, great! But if you don't, start thinking about where you could add value and how you could turn those thoughts into action.

Online earning money is easy if you are looking for opportunities that match your interests and skills.

If you are passionate about creating apps and websites, you can find many opportunities to generate revenue while you're sleeping.

If you are more interested in writing, reviewing products might be a good option. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever topic you choose to focus on, ensure that it's something you enjoy. This will ensure that you stick with it for the long-term.

Once you have found a product/service that you enjoy selling, you will need to find a way to make it monetizable.

There are two main options. You can charge a flat price for your services (like a freelancer), but you can also charge per job (like an agency).

In either case, once you've set your rates, you'll need to promote them. This means sharing them on social media, emailing your list, posting flyers, etc.

To increase your chances of success, keep these three tips in mind when promoting your business:

-

e professional - always act like a professional when doing anything related to marketing. You never know who may be reading your content.

-

Know your subject matter before you speak. After all, no one likes a fake expert.

-

Don't spam - avoid emailing everyone in your address book unless they specifically asked for information. You can send a recommendation to someone who has asked for it.

-

Use a good email service provider. Yahoo Mail or Gmail are both free.

-

Monitor your results: Track how many people open your messages and click links to sign up for your mailing list.

-

Your ROI can be measured by measuring how many leads each campaign generates and which campaigns convert the most.

-

Get feedback - Ask your friends and family if they are interested in your services and get their honest feedback.

-

Try different strategies - you may find that some work better than others.

-

You must continue learning and remain relevant in marketing.

What's the difference between passive income vs active income?

Passive income can be defined as a way to make passive income without any work. Active income is earned through hard work and effort.

You create value for another person and earn active income. It is when someone buys a product or service you have created. For example, selling products online, writing an ebook, creating a website, advertising your business, etc.

Passive income is great as it allows you more time to do important things while still making money. Most people aren’t keen to work for themselves. They choose to make passive income and invest their time and energy.

The problem with passive income is that it doesn't last forever. If you hold off too long in generating passive income, you may run out of cash.

It is possible to burn out if your passive income efforts are too intense. You should start immediately. If you wait until later to start building passive income, you'll probably miss out on opportunities to maximize your earnings potential.

There are three types passive income streams.

-

These include starting a business, owning a franchise or becoming a freelancer. You could also rent the property, such as real-estate, to other people.

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real estate - This includes buying and flipping homes, renting properties, and investing in commercial real property.

Statistics

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

External Links

How To

How to Make Money at Home

There is always room for improvement, no matter what online income you have. But even the most successful entrepreneurs struggle to grow their businesses and increase profits.

The problem is that when you're starting, it's easy to get stuck in a rut--to focus solely on making revenue rather than growing your business. You may spend more time on marketing rather than product development. You might even neglect customer service.

That's why it's critical to periodically evaluate your progress--and ask yourself whether you're improving your bottom line or simply maintaining the status quo. These are five ways to increase your income.

Productivity isn’t about the output. To be productive, you must also be able accomplish your tasks. Find the parts of your job that take the most effort or energy and assign those tasks to someone else.

Virtual assistants can be employed to help you manage customer support, social media management, and email management.

You could also assign a team member to create blog posts and another to manage your lead-generation campaigns. If you are delegating, make sure to choose people who will help your achieve your goals more quickly and better.

-

Focus on sales instead of marketing

Marketing doesn't mean spending a lot. Some of the greatest marketers are not paid employees. They are self-employed consultants, who make commissions on the sale of their services.

Instead of advertising products on television, radio and in print ads, consider affiliate programs that allow you to promote the goods and services of other businesses. For sales to occur, you don't have necessarily to buy high-end inventory.

-

Hire An Expert To Do What You Can't

If you lack expertise in certain areas, hire freelancers to fill the gaps. Hire a freelance designer to create graphics on your site if you aren’t an expert in graphic design.

-

Get Paid Faster By Using Invoice Apps

Invoicing can be time-consuming when you're a contractor. It's especially tedious when you have multiple clients who each want different things.

FreshBooks and Xero allow you to quickly and easily invoice your customers. All your client information can be entered once and invoices sent directly from the app.

-

Get More Product Sales With Affiliate Programs

Because affiliate programs allow you to sell products without having to keep stock, they are great. You don't have to worry about shipping costs. All you need to do is set up a link between your website and the vendor's site. You will then receive a commission every time someone purchases something from the vendor. Affiliate programs are a great way to build your brand and make more money. You can attract your audience as long you provide quality content.