You will be charged an APR (interest rate) when you buy something with your credit card. The APR is applicable to all purchases and generally ranges from three to three-and-a-half percent per month. You should check the APR before making any purchase.

Variable APR

Variable APR can make it difficult for you to manage your finances. But the good news is that your card's interest rates can be easily changed to one that's lower. Credit card companies are not required to inform cardholders of changes in variable APR. However, if you have excellent credit you may be able to ask them to lower your rate. If you pay your balance each month, you may be able to switch to a card at a lower rate.

Variable APR credit card issuers may change the interest rates on a credit card at their discretion, but they must adhere to the terms of the cardmember agreement. Fixed APR credit card issuers must give you written notice within 45 days of changing the interest rate. In addition, if you don't agree with the changes, you can always terminate the account and stop using your card.

APR initial

You might be eligible for an introductory annual percentage rate when you open new credit cards. The introductory rate is usually lower than the regular rate and sometimes even as low as 0 percent. This rate applies to purchases and balance transfers, and is valid for 12 months. The regular rate will be in effect after that time. Cash advances have no grace period and are subject to the introductory rate.

The minimum monthly payment may be required or you could lose your introductory APR. For the regular purchase rates, it is important to read your credit card terms and conditions. Paying off the balance in full before the introductory period ends is the best way to get an introductory purchase interest rate.

Penalty APR

You might want to transfer your balance from one credit card to another if your credit card has a high interest rate. This can help you pay off your balance more quickly. Ask your credit card provider to lower your interest rate. You should also ask when it will take for the interest rate to drop.

If you fall behind on payments, the interest rate you'll be charged is called the penalty APR. The APR is applied to the total amount of your account balance when you defaulted on payments. This applies to all balances you incur until the creditcard issuer restores normal interest rates. If you have a high balance on your card, the penalty APR will continue for at least six months. You can request your credit card company to lower your APR if you have paid your bills on time.

APR for cash advance

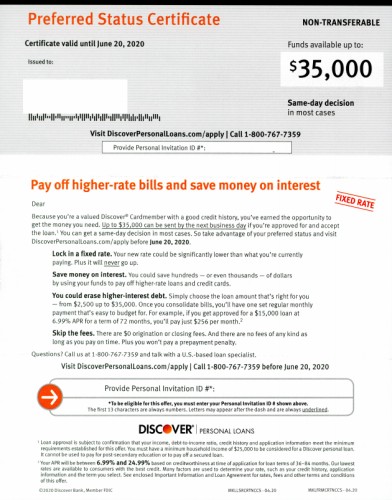

A cash advance on a credit card is a fast and convenient solution to short-term funds issues. However, the APR and transaction fees can quickly add up and hurt your credit rating. There are steps that you can take to lower the cost and keep the interest rate low. First, only take out what you actually need.

Check your account before you apply for a cash advance. Make sure to read the terms and conditions. It is important to only borrow what you really need and pay it off as quickly as possible. You also have the option of a personal loan that can be approved in just a few hours and can be used to fund a wide range of things.

Balance transfer APR

The APR on balance transfer credit cards can vary significantly depending on the issuer and the promotional terms they offer. We've compared major issuers and analyzed the terms and conditions of several cards to give you an idea of what to look for. It is important to consider the APR and minimum payment.

You should also check your credit score before transferring balances. Your score will be lower if it isn't very high. Before you apply, check your credit report and score. Once you've done that, you can contact the new creditor to begin the process. People most often choose to transfer credit cards, but personal loans can also be transferred.

FAQ

What is the distinction between passive income, and active income.

Passive income refers to making money while not working. Active income requires hardwork and effort.

You create value for another person and earn active income. It is when someone buys a product or service you have created. Selling products online, writing ebooks, creating websites, and advertising your business are just a few examples.

Passive income can be a great option because you can put your efforts into more important things and still make money. Most people aren’t keen to work for themselves. So they choose to invest time and energy into earning passive income.

The problem with passive income is that it doesn't last forever. If you wait too long before you start to earn passive income, it's possible that you will run out.

In addition to the danger of burnout, if you spend too many hours trying to generate passive income, You should start immediately. You'll miss out on the best opportunities to maximize your earning potential if you wait to build passive income.

There are 3 types of passive income streams.

-

Business opportunities include opening a franchise, creating a blog or freelancer, as well as renting out property like real estate.

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real Estate - These include buying land, flipping houses and investing in real estate.

What is the easiest way to make passive income?

There are many options for making money online. However, most of these require more effort and time than you might think. How do you make extra cash easy?

The answer is to find something you love, whether blogging, writing, designing, selling, marketing, etc. That passion can be monetized.

For example, let's say you enjoy creating blog posts. Start a blog where you share helpful information on topics related to your niche. Then, when readers click on links within those articles, sign them up for emails or follow you on social media sites.

This is called affiliate marketing, and there are plenty of resources to help you get started. Here are 101 affiliate marketing tips and resources.

You could also consider starting a blog as another form of passive income. Once again, you'll need to find a topic you enjoy teaching about. However, once you've established your site, you can monetize it by offering courses, ebooks, videos, and more.

While there are many methods to make money online there are some that are more effective than others. It is important to focus on creating websites and blogs that provide valuable information if your goal is to make money online.

Once your website is built, you can promote it via social media sites such as Facebook, Twitter, LinkedIn and Pinterest. This is what's known as content marketing. It's a great way for you to drive traffic back your site.

How can a beginner earn passive income?

Start with the basics. Learn how to create value and then discover ways to make a profit from that value.

You might even already have some ideas. If you do, great! If you do, great!

Finding a job that matches your interests and skills is the best way to make money online.

You can create websites or apps that you love, and generate revenue while sleeping.

Writing is your passion, so you might like to review products. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever topic you choose to focus on, ensure that it's something you enjoy. It will be a long-lasting commitment.

Once you find a product/service you love helping people buy, it's time to figure out how you can monetize it.

There are two main ways to go about this. One is to charge a flat rate for your services (like a freelancer), and the second is to charge per project (like an agency).

In both cases, once you have set your rates you need to make them known. This means sharing them on social media, emailing your list, posting flyers, etc.

These three tips will help you increase your chances for success when marketing your business.

-

When marketing, be a professional. It is impossible to predict who might be reading your content.

-

Know what you are talking about. Before you start to talk about your topic, make sure that you have a thorough understanding of the subject. No one wants to be a fake expert.

-

Avoid spamming - unless someone specifically requests information, don't email everyone in your contact list. For a recommendation, email it to the person who asked.

-

Make sure you have a reliable email provider. Yahoo Mail and Gmail are both free and easy-to-use.

-

Monitor your results - track how many people open your messages, click links, and sign up for your mailing lists.

-

You can measure your ROI by measuring the number of leads generated for each campaign and determining which campaigns are most successful in converting them.

-

Get feedback. Ask friends and relatives if they would be interested and receive honest feedback.

-

Try different strategies - you may find that some work better than others.

-

Learn and keep growing as a marketer to stay relevant.

What are the top side hustles that will make you money in 2022

The best way to make money today is to create value for someone else. If you do it well, the money will follow.

While you might not know it, your contribution to the world has been there since day one. When you were a baby, you sucked your mommy's breast milk and she gave you life. When you learned how to walk, you gave yourself a better place to live.

Giving value to your friends and family will help you make more. Actually, the more that you give, the greater the rewards.

Value creation is a powerful force that everyone uses every day without even knowing it. You create value every day, whether you are cooking for your family, driving your children to school, emptying the trash or just paying the bills.

In actuality, Earth is home to nearly 7 billion people right now. This means that every person creates a tremendous amount of value each day. Even if you created $1 worth of value an hour, that's $7 million a year.

This means that you would earn $700,000.000 more a year if you could find ten different ways to add $100 each week to someone's lives. You would earn far more than you are currently earning working full-time.

Let's imagine you wanted to make that number double. Let's imagine you could find 20 ways of adding $200 per month to someone's lives. Not only would you earn another $14.4 million dollars annually, you'd also become incredibly wealthy.

There are millions of opportunities to create value every single day. This includes selling ideas, products, or information.

Even though we spend much of our time focused on jobs, careers, and income streams, these are merely tools that help us accomplish our goals. The ultimate goal is to assist others in achieving theirs.

To get ahead, you must create value. You can get my free guide, "How to Create Value and Get Paid" here.

How does rich people make passive income from their wealth?

If you're trying to create money online, there are two ways to go about it. The first is to create great products or services that people love and will pay for. This is called "earning" money.

A second option is to find a way of providing value to others without creating products. This is "passive" income.

Let's assume you are the CEO of an app company. Your job is developing apps. Instead of selling apps directly to users you decide to give them away free. That's a great business model because now you don't depend on paying users. Instead, you rely on advertising revenue.

To help you pay your bills while you build your business, you may also be able to charge customers monthly.

This is how most successful internet entrepreneurs earn money today. They give value to others rather than making stuff.

How much debt are you allowed to take on?

It is essential to remember that money is not unlimited. If you spend more than you earn, you'll eventually run out of cash because it takes time for savings to grow. If you are running out of funds, cut back on your spending.

But how much is too much? While there is no one right answer, the general rule of thumb is to live within 10% your income. You'll never go broke, even after years and years of saving.

This means that you shouldn't spend more money than $10,000 a year if your income is $10,000. You shouldn't spend more that $2,000 monthly if your income is $20,000 And if you make $50,000, you shouldn't spend more than $5,000 per month.

It's important to pay off any debts as soon and as quickly as you can. This includes student loans, credit card debts, car payments, and credit card bill. When these are paid off you'll have money left to save.

It would be best if you also considered whether or not you want to invest any of your surplus income. You may lose your money if the stock markets fall. However, if the money is put into savings accounts, it will compound over time.

Let's take, for example, $100 per week that you have set aside to save. Over five years, that would add up to $500. After six years, you would have $1,000 saved. In eight years, your savings would be close to $3,000 It would take you close to $13,000 to save by the time that you reach ten.

In fifteen years you will have $40,000 saved in your savings. That's quite impressive. If you had made the same investment in the stock markets during the same time, you would have earned interest. Instead of $40,000, you'd now have more than $57,000.

This is why it is so important to understand how to properly manage your finances. A poor financial management system can lead to you spending more than you intended.

Statistics

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

External Links

How To

How to Make Money Online

The way people make money online today is very different than 10 years ago. The way you invest your money is also changing. There are many ways to earn passive income, but most require a lot of upfront investment. Some methods are more difficult than others. Before you start investing your hard-earned money in any endeavor, you must consider these important points.

-

Find out which type of investor you are. If you're looking to make quick bucks, you might find yourself attracted to programs like PTC sites (Pay per click), where you get paid for simply clicking ads. However, if long-term earning potential is more important to you, you might consider affiliate marketing opportunities.

-

Do your research. Do your research before you sign up for any program. Review, testimonials and past performance records are all good places to start. It is not worth wasting your time and effort only to find out that the product does not work.

-

Start small. Don't jump straight into one large project. Instead, you should start by building something small. This will allow you to learn the ropes and help you decide if this business is for you. Once you feel confident enough to take on larger projects.

-

Get started now! You don't have to wait too long to start making money online. Even if it's been years since you last worked full-time, you still have enough time to build a solid portfolio niche websites. All you need are a great idea and some dedication. Get started today and get involved!