Although credit cards make it easy to make purchases, a personal loans is better for long-term repayment. Both loans are secured by credit. You will need to consider your personal circumstances before making the right decision. You can use either for smaller expenses or larger expenditures. Both types have their pros and cons. It is important to weigh the pros and cons before making your decision.

First, decide if you need a card or a loan. A card allows you to borrow money without having to put up collateral, which makes it a more convenient option. A personal loan may be better if you need to borrow large amounts of money.

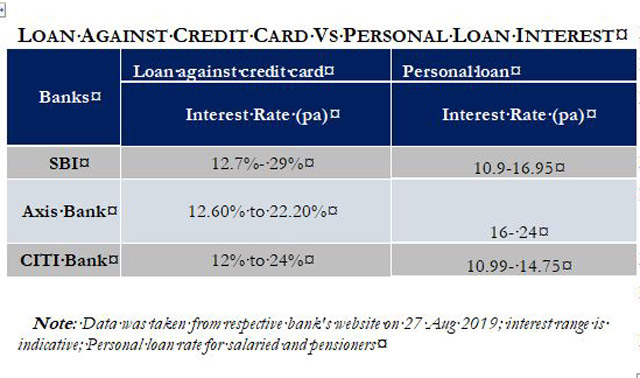

The main difference between a credit card and a loan is the interest rate. Personal loans usually have a fixed interest rate while credit cards are subject to variable rates. A card with a lower credit rate might be a better deal depending on your credit history. A promotional period will end if you pay off your balance by the due date. This will help you save substantial interest costs.

There are some differences between a personal loan and credit card, but the most important is the repayment term. Lenders will typically limit you to borrowing for five years. Personal loans require you to make monthly payments. Like credit cards, you will have to make monthly payments if your credit score is negatively affected.

The best thing about a personal loan? It can be used for almost any purpose. You may be able to borrow the money to pay for a car or a computer. Personal loans have the added benefit of helping you save money. Personal loans are easy to budget for and a great way of covering short-term expenses. If you have a low amount of debt, it might be a smarter decision to borrow money with a credit card in the long-term.

The most important aspect in deciding the right option for you is how much money you have. Both options will help you to fund your needs, but you need to weigh the pros and cons of each before you make a decision.

A credit card has one of the greatest drawbacks: you don't have control over what you spend. This is particularly true if your credit card has a revolving line. Another problem is that you don’t have the security provided by a collateral line. However, personal loans can save you interest. Similarly, if you need a loan to buy a home, you should consider home equity loans, which typically have a lower interest rate than credit cards.

While a credit card and a personal loan both offer the convenience of being able to borrow money, a credit card is probably the better choice if you're looking to get the most bang for your buck. Credit cards come with a few other advantages, including the ability to quickly finance your purchase, pay off your balance and earn rewards. You can earn money by using credit cards that offer cashback programs.

FAQ

What is the easiest way to make passive income?

There are many options for making money online. Some of these take more time and effort that you might realize. How can you make it easy for yourself to make extra money?

Find something that you are passionate about, whether it's writing, design, selling, marketing, or blogging. You can then monetize your passion.

For example, let's say you enjoy creating blog posts. You can start a blog that shares useful information about topics in your niche. When readers click on the links in those articles, they can sign up for your emails or follow you via social media.

This is called affiliate marketing, and there are plenty of resources to help you get started. Here's a collection of 101 affiliate marketing tips & resources.

A blog could be another way to make passive income. Again, you will need to find a topic which you love teaching. You can also make your site monetizable by creating ebooks, courses and videos.

While there are many options for making money online, the most effective ones are the easiest. If you really want to make money online, focus on building websites or blogs that provide useful information.

Once you have created your website, share it on social media such as Facebook and Twitter. This is known as content marketing and it's a great way to drive traffic back to your site.

What side hustles will be the most profitable in 2022

It is best to create value for others in order to make money. If you do it well, the money will follow.

Although you may not be aware of it, you have been creating value from day one. You sucked your mommy’s breast milk as a baby and she gave life to you. You made your life easier by learning to walk.

Giving value to your friends and family will help you make more. Actually, the more that you give, the greater the rewards.

Without even realizing it, value creation is a powerful force everyone uses every day. It doesn't matter if you're cooking dinner or driving your kids to school.

In actuality, Earth is home to nearly 7 billion people right now. Each person creates an incredible amount of value every day. Even if your hourly value is $1, you could create $7 million annually.

That means that if you could find ten ways to add $100 to someone's life per week, you'd earn an extra $700,000 a year. This is a lot more than what you earn working full-time.

Now, let's say you wanted to double that number. Let's imagine you could find 20 ways of adding $200 per month to someone's lives. You would not only be able to make $14.4 million more annually, but also you'd become very wealthy.

There are millions of opportunities to create value every single day. This includes selling information, products and services.

Even though we spend much of our time focused on jobs, careers, and income streams, these are merely tools that help us accomplish our goals. Helping others achieve theirs is the real goal.

Focus on creating value if you want to be successful. Start by downloading my free guide, How to Create Value and Get Paid for It.

What is personal finance?

Personal finance involves managing your money to meet your goals at work or home. It is about understanding your finances, knowing your budget, and balancing your desires against your needs.

These skills will allow you to become financially independent. This means that you won't have to rely on others for your financial needs. You're free from worrying about paying rent, utilities, and other bills every month.

You can't only learn how to manage money, it will help you achieve your goals. You'll be happier all around. You will feel happier about your finances and be more satisfied with your life.

So who cares about personal finance? Everyone does! Personal finance is a very popular topic today. Google Trends shows that searches for "personal finances" have increased by 1,600% in the past four years.

Today, people use their smartphones to track budgets, compare prices, and build wealth. You can read blogs such as this one, view videos on YouTube about personal finances, and listen to podcasts that discuss investing.

Bankrate.com estimates that Americans spend on average 4 hours per day viewing TV, listening to music and playing video games, as well reading books and talking with friends. That leaves only two hours a day to do everything else that matters.

If you are able to master personal finance, you will be able make the most of it.

Why is personal finance so important?

If you want to be successful, personal financial management is a must-have skill. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

Why should we save money when there are better things? Is it not better to use our time or energy on something else?

Yes and no. Yes, most people feel guilty saving money. It's not true, as more money means more opportunities to invest.

If you can keep your eyes on what is bigger, you will always be able spend your money wisely.

You must learn to control your emotions in order to be financially successful. If you are focusing on the negative aspects of your life, you will not have positive thoughts that can support you.

Also, you may have unrealistic expectations about the amount of money that you will eventually accumulate. This is because your financial management skills are not up to par.

Once you have mastered these skills you will be ready for the next step, learning how budgeting works.

Budgeting is the practice of setting aside some of your monthly income for future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

Now that you understand how to best allocate your resources, it is possible to start looking forward to a better financial future.

What is the difference in passive income and active income?

Passive income means that you can make money with little effort. Active income requires work and effort.

If you are able to create value for somebody else, then that's called active income. You earn money when you offer a product or service that someone needs. This could include selling products online or creating ebooks.

Passive income is great because it allows you to focus on more important things while still making money. Most people aren’t keen to work for themselves. So they choose to invest time and energy into earning passive income.

Passive income isn't sustainable forever. If you are not quick enough to start generating passive income you could run out.

Also, you could burn out if passive income is not generated in a timely manner. So it's best to start now. You will miss opportunities to maximize your earnings potential if you put off building passive income.

There are three types to passive income streams.

-

There are several options available for business owners: you can start a company, buy a franchise and become a freelancer. Or rent out your property.

-

Investments include stocks, bonds, mutual funds, ETFs, and ETFs.

-

Real Estate - These include buying land, flipping houses and investing in real estate.

How can a beginner make passive money?

Start with the basics, learn how to create value for yourself, and then find ways to make money from that value.

You might have some ideas. If you do, great! You're great!

Online earning money is easy if you are looking for opportunities that match your interests and skills.

If you are passionate about creating apps and websites, you can find many opportunities to generate revenue while you're sleeping.

Reviewing products is a great way to express your creativity. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever topic you choose to focus on, ensure that it's something you enjoy. It will be a long-lasting commitment.

Once you have found a product/service that you enjoy selling, you will need to find a way to make it monetizable.

There are two main approaches to this. You can either charge a flat fee (like a freelancer) or you can charge per project (like an agent).

Either way, once you have established your rates, it's time to market them. This means sharing them on social media, emailing your list, posting flyers, etc.

These are three ways to improve your chances of success in marketing your business.

-

Market like a professional: Always act professional when you do anything in marketing. You never know who will review your content.

-

Know your subject matter before you speak. A fake expert is not a good idea.

-

Spam is not a good idea. You should avoid emailing anyone in your address list unless they have asked specifically for it. Do not send out a recommendation if someone asks.

-

Use a good email service provider. Yahoo Mail or Gmail are both free.

-

Monitor your results. Track who opens your messages, clicks on links, and signs up for your mailing lists.

-

Your ROI can be measured by measuring how many leads each campaign generates and which campaigns convert the most.

-

Get feedback. Ask friends and relatives if they would be interested and receive honest feedback.

-

Different strategies can be tested - test them all to determine which one works best.

-

Learn new things - Keep learning to be a marketer.

Statistics

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

External Links

How To

How passive income can improve cash flow

It is possible to make money online with no hard work. There are many ways to earn passive income online.

Perhaps you have an existing business which could benefit from automation. If you are thinking of starting a business, you might find that automating parts of your workflow can help you save time and increase productivity.

Automating your business is a great way to increase its efficiency. This will allow you to focus more on your business and less on running it.

Outsourcing tasks can be a great way to automate them. Outsourcing allows you to focus on what matters most when running your business. When you outsource a task, it is effectively delegating the responsibility to another person.

This means that you can focus on the important aspects of your business while allowing someone else to manage the details. Outsourcing can make it easier to grow your company because you won’t have to worry too much about the small things.

Turn your hobby into a side-business. A side hustle is another option to generate additional income.

Articles are an example of this. There are many places where you can post your articles. These sites allow you to earn additional monthly cash because they pay per article.

You can also consider creating videos. Many platforms allow you to upload videos to YouTube or Vimeo. These videos can drive traffic to your website or social media pages.

Another way to make extra money is to invest your capital in shares and stocks. Investing is similar as investing in real property. You are instead paid rent. Instead, you receive dividends.

They are included in your dividend when shares you buy are purchased. The amount of your dividend will depend on how much stock is purchased.

You can reinvest your profits in buying more shares if you decide to sell your shares. This will ensure that you continue to receive dividends.