Consolidating debts for secured loans comes with some drawbacks and benefits. Consumers using these loans mean that banks and credit card firms are less likely lose money. However, consumers face a greater risk of losing an asset if they fail to repay the loan. Consumers should consider all options before making a decision.

Streamlining repayment

Federal government will introduce a new program to ease the repayment of secured loans. This new program, called Streamlined Modification, will expand on the Standard Modification program that was introduced last year. The new program allows servicers to send a streamlined modification solicitation offer to qualified borrowers. Borrowers don't have to prove hardship to be eligible for a modification offer. All they need to do is agree to the terms.

The new program makes income-driven borrowing more affordable while still offering fixed-payment options. It removes any confusion and is easier to use.

Additional fees

Secured loans can be a great way to consolidate debt and lower interest rates. This type of loan requires collateral that can be pledged to secure the loan. The lender will require collateral to be pledged as security for the loan. In order to lower interest costs, you may be able to extend the loan term. While this can provide some breathing room, it can lead to additional debt over time.

You can compare the options of several lenders to find the best debt consolidation loan. Compare interest rates, repayment terms, origination fees and eligibility requirements to see if the lender will directly pay you creditors.

Impact on credit rating

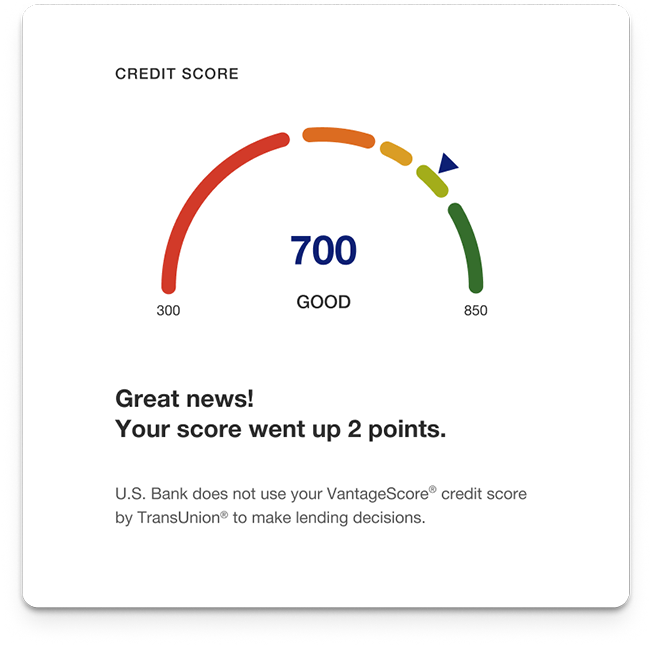

Secured loans can negatively impact your credit rating. The creditor will conduct a hard inquiry when you apply for a loan. This can lower your credit score by a few percentage points. This effect can be mitigated by opening a brand new account. You will have more credit.

Consolidating debt can also make it easier to pay off your debts faster. You will be able to save money and budget by making fewer payments. Your new payment will likely have lower interest rates, which could make it more affordable. However, keep in mind that the consolidation loan may have higher interest rates and a longer term than the original loans, and you will have to pay additional fees on top of that.

While debt consolidation loans will lower your monthly repayments, they also affect your credit score by lowering your debt to income ratio. DTI, also known as the debt-to–credit ratio, is 30 percent of your credit score. Having a DTI between 10 and 30% is good for credit. A DTI of more than 30% can negatively impact your credit score.

FAQ

How much debt is too much?

It is important to remember that too much money can be dangerous. Spending more than you earn will eventually lead to cash shortages. Savings take time to grow. If you are running out of funds, cut back on your spending.

But how much can you afford? There's no right or wrong number, but it is recommended that you live within 10% of your income. Even after years of saving, this will ensure you won't go broke.

This means that you shouldn't spend more money than $10,000 a year if your income is $10,000. If you make $20,000, you should' t spend more than $2,000 per month. And if you make $50,000, you shouldn't spend more than $5,000 per month.

It is important to get rid of debts as soon as possible. This includes credit card bills, student loans, car payments, etc. After these debts are paid, you will have more money to save.

It is best to consider whether or not you wish to invest any excess income. If you choose to invest your money in bonds or stocks, you may lose it if the stock exchange falls. However, if you put your money into a savings account you can expect to see interest compound over time.

As an example, suppose you save $100 each week. Over five years, that would add up to $500. After six years, you would have $1,000 saved. You'd have almost $3,000 in savings by the end of eight years. When you turn ten, you will have almost $13,000 in savings.

At the end of 15 years, you'll have nearly $40,000 in savings. It's impressive. But if you had put the same amount into the stock market over the same time period, you would have earned interest. Instead of $40,000 you would now have $57,000.

It's crucial to learn how you can manage your finances effectively. You might end up with more money than you expected.

How do you build passive income streams?

You must understand why people buy the things they do in order to generate consistent earnings from a single source.

That means understanding their needs and wants. This requires you to be able connect with people and make sales to them.

The next step is how to convert leads and sales. To retain happy customers, you need to be able to provide excellent customer service.

This is something you may not realize, but every product or service needs a buyer. If you know who this buyer is, your entire business can be built around him/her.

To become a millionaire it takes a lot. A billionaire requires even more work. Why? It is because you have to first become a 1,000aire before you can become a millionaire.

Then you must become a millionaire. Finally, you must become a billionaire. The same applies to becoming a millionaire.

How do you become a billionaire. It starts by being a millionaire. All you have to do in order achieve this is to make money.

However, before you can earn money, you need to get started. Let's discuss how to get started.

What is the difference between passive and active income?

Passive income can be defined as a way to make passive income without any work. Active income is earned through hard work and effort.

If you are able to create value for somebody else, then that's called active income. Earn money by providing a service or product to someone. You could sell products online, write an ebook, create a website or advertise your business.

Passive income is great because it allows you to focus on more important things while still making money. But most people aren't interested in working for themselves. They choose to make passive income and invest their time and energy.

Passive income doesn't last forever, which is the problem. If you are not quick enough to start generating passive income you could run out.

In addition to the danger of burnout, if you spend too many hours trying to generate passive income, You should start immediately. If you wait too long to begin building passive income you will likely miss out on potential opportunities to maximize earnings.

There are three types or passive income streams.

-

There are many options for businesses: You can own a franchise, start a blog, become a freelancer or rent out real estate.

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real Estate - this includes rental properties, flipping houses, buying land, and investing in commercial real estate

Which side hustles are most lucrative?

Side hustles can be described as any extra income stream that supplements your main source of income.

Side hustles are important as they can provide additional income for bills or fun activities.

Side hustles not only help you save money for retirement but also give you flexibility and can increase your earning potential.

There are two types side hustles: active and passive. Passive side hustles include online businesses such as e-commerce stores, blogging, and freelancing. You can also do side hustles like tutoring and dog walking.

Side hustles that work for you are easy to manage and make sense. Consider starting a business in fitness if your passion is working out. If you enjoy spending time outdoors, consider becoming a freelance landscaper.

Side hustles are available anywhere. Side hustles can be found anywhere.

One example is to open your own graphic design studio, if graphic design experience is something you have. Perhaps you're an experienced writer so why not go ghostwriting?

Be sure to research thoroughly before you start any side hustle. This way, when the opportunity arises, you'll be ready to jump right in and take advantage of it.

Side hustles are not just about making money. Side hustles are about creating wealth and freedom.

And with so many ways to earn money today, there's no excuse to start one!

What is the best passive income source?

There are tons of ways to make money online. Most of them take more time and effort than what you might expect. How do you find a way to earn more money?

You need to find what you love. You can then monetize your passion.

For example, let's say you enjoy creating blog posts. Start a blog where you share helpful information on topics related to your niche. Then, when readers click on links within those articles, sign them up for emails or follow you on social media sites.

This is called affiliate marketing. You can find plenty of resources online to help you start. For example, here's a list of 101 Affiliate Marketing Tools, Tips & Resources.

You might also think about starting a blog to earn passive income. It's important to choose a topic you are passionate about. Once you have established your website, you can make it a monetizable resource by selling ebooks, courses, and videos.

While there are many options for making money online, the most effective ones are the easiest. Focus on creating websites or blogs that offer valuable information if you want to make money in the online world.

Once your website is built, you can promote it via social media sites such as Facebook, Twitter, LinkedIn and Pinterest. This is known as content marketing and it's a great way to drive traffic back to your site.

Why is personal finance important?

For anyone to be successful in life, financial management is essential. In a world of tight money, we are often faced with difficult decisions about how much to spend.

So why do we put off saving money? Is there anything better to spend our energy and time on?

Both yes and no. Yes, as most people feel guilty about saving their money. It's not true, as more money means more opportunities to invest.

If you can keep your eyes on what is bigger, you will always be able spend your money wisely.

Financial success requires you to manage your emotions. When you focus on the negative aspects of your situation, you won't have any positive thoughts to support you.

Unrealistic expectations may also be a factor in how much you will end up with. You don't know how to properly manage your finances.

Once you have mastered these skills you will be ready for the next step, learning how budgeting works.

Budgeting is the act of setting aside a portion of your income each month towards future expenses. Planning will help you avoid unnecessary purchases and make sure you have enough money to pay your bills.

So now that you know how to allocate your resources effectively, you can begin to look forward to a brighter financial future.

Statistics

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

External Links

How To

How to make money online

Today's methods of making money online are very different from those used ten years ago. How you invest your funds is changing as well. There are many ways you can earn passive income. However, some require substantial upfront investment. Some methods are easier than other. Before you start investing your hard-earned money in any endeavor, you must consider these important points.

-

Find out who you are as an investor. You might be attracted to PTC sites (Pay per Click), which pay you for clicking ads. On the other hand, if you're more interested in long-term earning potential, then you might prefer to look at affiliate marketing opportunities.

-

Do your research. Before you commit to any program, you must do your homework. Review, testimonials and past performance records are all good places to start. You don't want your time or energy wasted only to discover that the product doesn’t work.

-

Start small. Do not just jump in to one huge project. Instead, start off by building something simple first. This will let you gain experience and help you determine if this type of business suits you. Once you feel confident enough, try expanding your efforts to bigger projects.

-

Get started now! It's never too soon to start making online money. Even if it's been years since you last worked full-time, you still have enough time to build a solid portfolio niche websites. All you need are a great idea and some dedication. So go ahead and take action today!