If you receive a garnishment letter from a creditor on the paycheck, you may object to it and request that your wages not go garnished. You may also be able to negotiate with your creditor in order to stop the garnishment. You can offer to settle the debt or post-date a cheque to avoid the garnishment.

Refusal to Garnishment

There are several ways to stop wage garnishment. First, you need to write an objection to the garnishment. You must include your name, case number, and contact information. Additional documents are also required. Finally, you must provide specific information about why you object to the garnishment. If the court accepts your objection, you'll get a hearing date.

The amount of your debt and the court rules in your jurisdiction will affect the garnishment process. In most cases, the garnishment process will include a notice right and hearing. These notices are available a few weeks before garnishment proceedings begin. In some instances, you may be given up to a whole month to respond.

Filing for bankruptcy

Learn about your state's laws if you are subject to wage garnishment for debt. In some states, creditors may take up to 25% from your paycheck after insurance and taxes. This amount can rise if you fall behind 12 weeks in payments. A tax agency can garnish your wages with no court order. This is dependent on your tax deductions or dependents.

If you find that your paycheck is being garnished, it's a good idea to contact your creditor and file for bankruptcy to stop the garnishment. An attorney can help you reach out to the creditor and request that they stop the garnishment.

Negotiating a payment plan

Talk to your creditor about reducing the amount you are owed if you wish to stop garnishment from your paycheck. You may also be eligible to receive an exemption. This exemption is known as a head-of-household exemption and can help protect your paycheck. If you have dependents, you can also use this exemption.

If you fall behind in your payments, it is easy for creditors to garnish your paycheck. If you are unable to pay the debt, garnishment can be disputed. This is difficult because garnishments can be invalid, or if the creditor doesn't follow the correct legal process. The first step is to review the garnishment notice from the court and your employer's documents to ensure that you really owe the debt. It is also important to verify that the debt you owe hasn't been paid. If you've filed for bankruptcy, this may also prevent garnishment.

Getting your money back if your paycheck was garnished

A garnishment is a legal procedure that takes money out of your paycheck to pay off your debts. Contact a Minnesota bankruptcy attorney immediately if you find yourself in such a situation. There are several types of bankruptcy that can help you recover your money, including Chapter 7 and Chapter 13.

Certain income types are exempted from garnishment. If you have $1000 in cash or a bank account, you can file a claim for exemption with the IRS. This will protect your money and property from being taken by the collection agency. You can file for exemption up to five business days after the garnishment date in some states.

FAQ

How to build a passive income stream?

You must understand why people buy the things they do in order to generate consistent earnings from a single source.

That means understanding their needs and wants. Learn how to connect with people to make them feel valued and be able to sell to them.

Next, you need to know how to convert leads to sales. To retain happy customers, you need to be able to provide excellent customer service.

You may not realize this, but every product or service has a buyer. You can even design your entire business around that buyer if you know what they are.

You have to put in a lot of effort to become millionaire. It takes even more work to become a billionaire. Why? Because to become a millionaire, you first have to become a thousandaire.

You can then become a millionaire. You can also become a billionaire. It is the same for becoming a billionaire.

How can someone become a billionaire. Well, it starts with being a thousandaire. To achieve this, all you have to do is start earning money.

But before you can begin earning money, you have to get started. Let's look at how to get going.

What is the fastest way you can make money in a side job?

If you want money fast, you will need to do more than simply create a product/service to solve a problem.

You must also find a way of establishing yourself as an authority in any niche that you choose. This means that you need to build a reputation both online and offline.

Helping other people solve their problems is the best way for a person to earn a good reputation. Consider how you can bring value to the community.

Once you answer that question you'll be able instantly to pinpoint the areas you're most suitable to address. There are countless ways to earn money online, and even though there are plenty of opportunities, they're often very competitive.

If you are careful, there are two main side hustles. The first involves selling products or services directly to customers. The second involves consulting services.

Each approach has pros and cons. Selling products and services can provide instant gratification since once you ship the product or deliver the service, payment is received immediately.

But, on the other hand, you might not have the success you desire if you do not spend the time to build relationships with potential clientele. Additionally, there is intense competition for these types of gigs.

Consulting can help you grow your business without having to worry about shipping products and providing services. However, it can take longer to be recognized as an expert in your area.

It is essential to know how to identify the right clientele in order to succeed in each of these options. It will take some trial-and-error. It pays off in the end.

What is the distinction between passive income, and active income.

Passive income refers to making money while not working. Active income requires hard work and effort.

You create value for another person and earn active income. Earn money by providing a service or product to someone. Examples include creating a website, selling products online and writing an ebook.

Passive income can be a great option because you can put your efforts into more important things and still make money. Most people aren’t keen to work for themselves. People choose to work for passive income, and so they invest their time and effort.

The problem with passive income is that it doesn't last forever. If you wait too long before you start to earn passive income, it's possible that you will run out.

Also, you could burn out if passive income is not generated in a timely manner. So it's best to start now. If you wait to start earning passive income, you might miss out opportunities to maximize the potential of your earnings.

There are three types to passive income streams.

-

These include starting a business, owning a franchise or becoming a freelancer. You could also rent the property, such as real-estate, to other people.

-

Investments - These include stocks, bonds and mutual funds as well ETFs.

-

Real Estate includes flipping houses, purchasing land and renting properties.

What is personal finance?

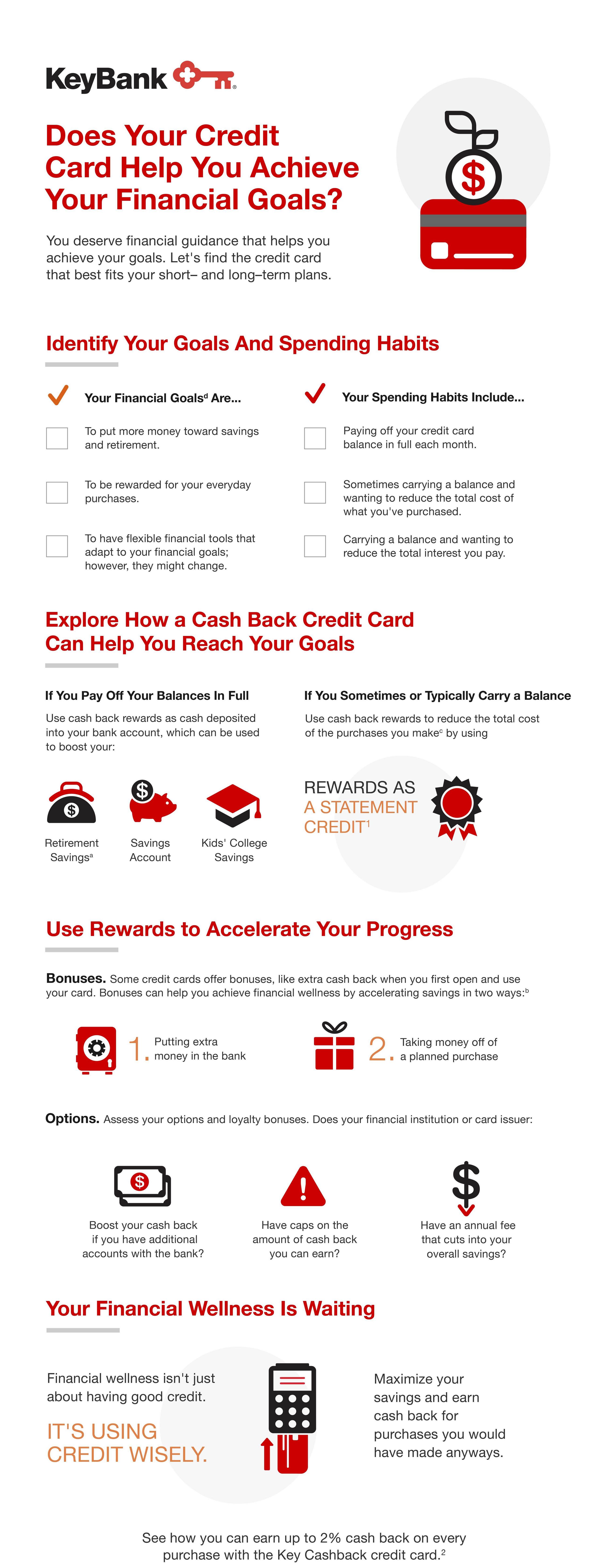

Personal finance is the art of managing your own finances to help you achieve your financial goals. It is about understanding your finances, knowing your budget, and balancing your desires against your needs.

Learning these skills will make you financially independent. You won't need to rely on anyone else for your needs. You don't need to worry about monthly rent and utility bills.

It's not enough to learn how money management can help you make more money. It makes you happier overall. Positive financial health can make it easier to feel less stressed, be promoted more quickly, and live a happier life.

What does personal finance matter to you? Everyone does! The most searched topic on the Internet is personal finance. Google Trends indicates that search terms for "personal finance” have seen a 1,600% increase in searches between 2004-2014.

Today's smartphone users use their phones to compare prices, track budgets and build wealth. These people read blogs like this one and watch YouTube videos about personal finance. They also listen to podcasts on investing.

Bankrate.com estimates that Americans spend on average 4 hours per day viewing TV, listening to music and playing video games, as well reading books and talking with friends. That leaves only two hours a day to do everything else that matters.

Financial management will allow you to make the most of your financial knowledge.

How can rich people earn passive income?

There are two options for making money online. Another way is to make great products (or service) that people love. This is known as "earning" money.

A second option is to find a way of providing value to others without creating products. This is known as "passive income".

Let's imagine you own an App Company. Your job is to develop apps. But instead of selling the apps to users directly, you decide that they should be given away for free. This is a great business model as you no longer depend on paying customers. Instead, you can rely on advertising revenue.

Customers may be charged monthly fees in order to sustain your business while you are building it.

This is how successful internet entrepreneurs today make their money. They are more focused on providing value than creating stuff.

How can a beginner make passive income?

Learn the basics and how to create value yourself. Then, find ways to make money with that value.

You might even have some ideas. If you do, great! If you do, great!

You can make money online by looking for opportunities that match you skills and interests.

You can create websites or apps that you love, and generate revenue while sleeping.

Writing is your passion, so you might like to review products. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever you decide to focus on, make sure you choose something that you enjoy. If you enjoy it, you will stick with the decision for the long-term.

Once you find a product/service you love helping people buy, it's time to figure out how you can monetize it.

You have two options. You can charge a flat price for your services (like a freelancer), but you can also charge per job (like an agency).

In each case, once your rates have been set, you will need to promote them. This includes sharing your rates on social media and emailing your subscribers, as well as posting flyers and other promotional materials.

These three tips will help you increase your chances for success when marketing your business.

-

Be a professional in all aspects of marketing. It is impossible to predict who might be reading your content.

-

Be knowledgeable about the topic you are discussing. A fake expert is not a good idea.

-

Avoid spamming - unless someone specifically requests information, don't email everyone in your contact list. For a recommendation, email it to the person who asked.

-

Make sure to choose a quality email provider. Yahoo Mail, Gmail, and Yahoo Mail are both free.

-

Monitor your results. Track who opens your messages, clicks on links, and signs up for your mailing lists.

-

Measuring your ROI is a way to determine which campaigns have the highest conversions.

-

Get feedback. Ask friends and relatives if they would be interested and receive honest feedback.

-

Different strategies can be tested - test them all to determine which one works best.

-

Learn and keep growing as a marketer to stay relevant.

Statistics

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

External Links

How To

Get passive income ideas to increase cash flow

There are many online ways to make extra money without any hard work. There are many ways to earn passive income online.

You may already have an existing business that could benefit from automation. Automating parts of your business workflow could help you save time, increase productivity, and even make it easier to start one.

The more automated your company becomes, the more efficient you will see it become. This will enable you to devote more time to growing your business instead of running it.

Outsourcing tasks is an excellent way to automate them. Outsourcing allows you to focus on what matters most when running your business. Outsourcing a task is effectively delegating it.

You can concentrate on the most important aspects of your business and let someone else handle the details. Outsourcing can make it easier to grow your company because you won’t have to worry too much about the small things.

Turn your hobby into a side-business. It's possible to earn extra cash by using your skills and talents to develop a product or service that is available online.

You might consider writing articles if you are a writer. You have many options for publishing your articles. These websites pay per article, allowing you to earn extra monthly cash.

Another option is to make videos. Many platforms now enable you to upload videos directly to YouTube or Vimeo. You'll receive traffic to your website and social media pages when you post these videos.

One last way to make money is to invest in stocks and shares. Investing in stocks and shares is similar to investing in real estate. You get dividends instead of rent.

You receive shares as part of your dividend, when you buy shares. The amount of your dividend will depend on how much stock is purchased.

You can reinvest your profits in buying more shares if you decide to sell your shares. You will keep receiving dividends for as long as you live.