You may be able to negotiate with your creditor, if you are having difficulty paying off your credit card debt. You can negotiate a reduction or decrease in your interest rate. You also have the option of a hardship plan, or a workout agreement. This will lower your total amount owed and make it easier to pay the balance off faster.

Generally, when you begin negotiating with your creditor, you will start with a phone call. During this call, you should explain your situation. You should explain your financial situation and request information about the company's hardship programs. Document every conversation. It will be easier to make a legal document.

Once you have all of your information, it is possible to make a claim for lower payments. It is important to understand the effects of settlements on your credit reports. Settlement of debt is a negative credit mark that can negatively impact your future borrowing options.

Your creditor would be interested to know that you are ready to create a plan to get payments on time. They want to keep your business and will do anything to ensure that you make timely payments. They may not like it if you settle your account for less than the entire balance. They will usually suspend your account until the hardship program is completed.

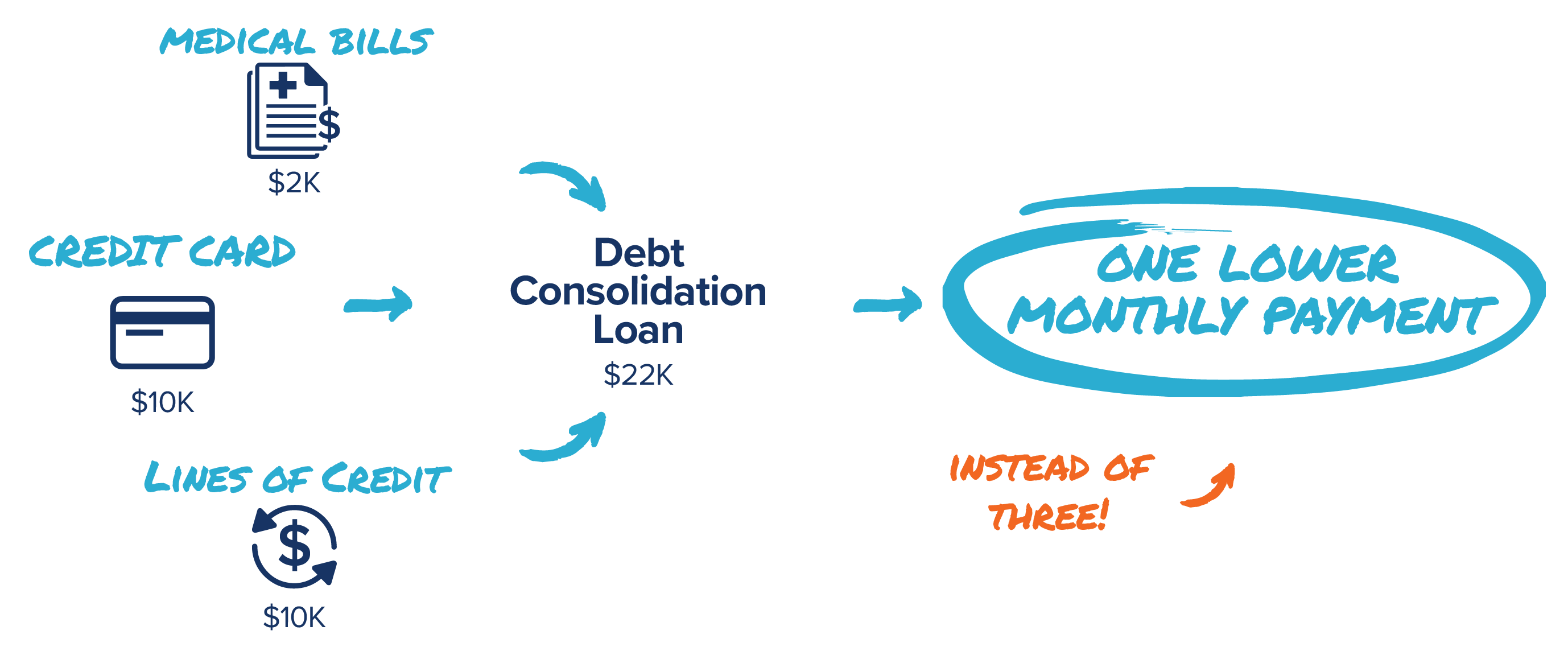

Before you contact your creditor to dispute your debt, it is important to look at the amount due on your account and to consider all of the options. You can also offer a lump-sum payment. A nonprofit credit counseling agency is another option. These agencies offer certified counselors who will give sound advice on managing your finances.

If you are able to clearly understand your financial situation, it will be easier for you to negotiate with creditors. You can have a lower debt-to-income ratio and less credit utilization to improve your financial situation.

While you are negotiating your credit card debt, you can expect to have long conversations over several weeks or even months. Based on the nature of your relationship with your creditor, you might be asked for your contact information. Keep a log of all conversations to keep track of what was said, and the result.

Once you have determined your options, contact the customer service department of your creditor. They can connect you to the appropriate department and provide you with the information you need.

Next, take down as much information as possible, such a monthly balance, interest rates, and payment details. During the negotiation, you will need to be patient and persistent. It is more likely that you will reach an agreement if your preparations are done properly.

Negotiating a repayment plan is the last step in credit card debt negotiation. This could include a lower interest rate, or a shorter minimum monthly payment. You might even be allowed to delay payments by some creditors.

FAQ

What is the fastest way to make money on a side hustle?

If you want money fast, you will need to do more than simply create a product/service to solve a problem.

It is also important to establish yourself as an authority in the niches you choose. That means building a reputation online as well as offline.

Helping others solve their problems is a great way to build a name. Ask yourself how you can be of value to your community.

After answering that question, it's easy to identify the areas in which you are most qualified to work. There are many ways to make money online.

When you really look, you will notice two main side hustles. One involves selling products directly to customers and the other is offering consulting services.

Each approach has its pros and cons. Selling products and services can provide instant gratification since once you ship the product or deliver the service, payment is received immediately.

The flip side is that you won't be able achieve the level you desire without building relationships and trust with potential clients. In addition, the competition for these kinds of gigs is fierce.

Consulting allows you to grow and manage your business without the need to ship products or provide services. However, it takes time to become an expert on your subject.

To be successful in either field, you must know how to identify the right customers. It takes some trial and error. But in the long run, it pays off big time.

What is the distinction between passive income, and active income.

Passive income refers to making money while not working. Active income requires hardwork and effort.

Active income is when you create value for someone else. You earn money when you offer a product or service that someone needs. This could include selling products online or creating ebooks.

Passive income is great because it allows you to focus on more important things while still making money. But most people aren't interested in working for themselves. So they choose to invest time and energy into earning passive income.

The problem with passive income is that it doesn't last forever. You might run out of money if you don't generate passive income in the right time.

In addition to the danger of burnout, if you spend too many hours trying to generate passive income, So it's best to start now. You'll miss out on the best opportunities to maximize your earning potential if you wait to build passive income.

There are 3 types of passive income streams.

-

Business opportunities include opening a franchise, creating a blog or freelancer, as well as renting out property like real estate.

-

These include stocks and bonds and mutual funds. ETFs are also investments.

-

Real estate - This includes buying and flipping homes, renting properties, and investing in commercial real property.

How to build a passive stream of income?

To make consistent earnings from one source you must first understand why people purchase what they do.

This means that you must understand their wants and needs. You must learn how to connect with people and sell to them.

Then you have to figure out how to convert leads into sales. To keep clients happy, you must be proficient in customer service.

This is something you may not realize, but every product or service needs a buyer. You can even design your entire business around that buyer if you know what they are.

A lot of work is required to become a millionaire. It takes even more work to become a billionaire. Why? It is because you have to first become a 1,000aire before you can become a millionaire.

And then you have to become a millionaire. You can also become a billionaire. You can also become a billionaire.

How can someone become a billionaire. Well, it starts with being a thousandaire. All you have do is earn money to get there.

You have to get going before you can start earning money. Let's now talk about how you can get started.

How do wealthy people earn passive income through investing?

If you're trying to create money online, there are two ways to go about it. You can create amazing products and services that people love. This is called earning money.

Another way is to create value for others and not spend time creating products. This is called "passive" income.

Let's say that you own an app business. Your job is to create apps. You decide to give away the apps instead of making them available to users. That's a great business model because now you don't depend on paying users. Instead, you can rely on advertising revenue.

In order to support yourself as you build your company, it may be possible to charge monthly fees.

This is how the most successful internet entrepreneurs make money today. Instead of making things, they focus on creating value for others.

Why is personal finance important?

For anyone to be successful in life, financial management is essential. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

Why then do we keep putting off saving money. Is it not better to use our time or energy on something else?

Yes and no. Yes, because most people feel guilty when they save money. Because the more money you earn the greater the opportunities to invest.

Spending your money wisely will be possible as long as you remain focused on the larger picture.

Controlling your emotions is key to financial success. Focusing on the negative aspects in your life will make it difficult to think positive thoughts.

It is possible to have unrealistic expectations of how much you will accumulate. This is because your financial management skills are not up to par.

Once you've mastered these skills, you'll be ready to tackle the next step - learning how to budget.

Budgeting is the practice of setting aside some of your monthly income for future expenses. You can plan ahead to avoid impulse purchases and have sufficient funds for your bills.

Now that you understand how to best allocate your resources, it is possible to start looking forward to a better financial future.

What side hustles can you make the most money?

Side hustle is an industry term that refers to any additional income streams that supplement your main source.

Side hustles can be very beneficial because they allow you to make extra money and provide fun activities.

Side hustles are a way to make more money, save time, and increase your earning power.

There are two types: active and passive side hustles. Side hustles that are passive include side businesses such as blogging, e-commerce and freelancing. Some of the active side hustles are tutoring, dog walking and selling eBay items.

Side hustles that are right for you fit in your daily life. A fitness business is a great option if you enjoy working out. You might consider working as a freelance landscaper if you love spending time outdoors.

There are many side hustles that you can do. Side hustles can be found anywhere.

If you are an expert in graphic design, why don't you open your own graphic design business? Perhaps you are a skilled writer, why not open your own graphic design studio?

Be sure to research thoroughly before you start any side hustle. You'll be ready to grab the opportunity when it presents itself.

Side hustles aren’t about making more money. They are about creating wealth, and freedom.

There are many ways to make money today so there's no reason not to start one.

Statistics

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

External Links

How To

For cash flow improvement, passive income ideas

There are many online ways to make extra money without any hard work. Instead, there are ways for you to make passive income from home.

There may be an existing business that could use automation. You might be thinking about starting your own business. Automating certain parts of your workflow may help you save time as well as increase productivity.

Your business will become more efficient the more it is automated. This means you will be able to spend more time working on growing your business rather than running it.

Outsourcing tasks is an excellent way to automate them. Outsourcing allows your business to be more focused on what is important. By outsourcing a task you effectively delegate it to another party.

This allows you to focus on the essential aspects of your business, while having someone else take care of the details. Outsourcing can make it easier to grow your company because you won’t have to worry too much about the small things.

You can also turn your hobby into an income stream by starting a side business. Using your skills and talents to create a product or service that can be sold online is another way to generate extra cash flow.

For example, if you enjoy writing, why not write articles? There are many places where you can post your articles. These websites offer a way to make extra money by publishing articles.

It is possible to create videos. Many platforms let you upload videos directly to YouTube and Vimeo. When you upload these videos, you'll get traffic to both your website and social networks.

Stocks and shares are another way to make some money. Investing in shares and stocks is similar to investing real estate. You get dividends instead of rent.

When you buy shares, they are given to you as part of your dividend. The amount of your dividend will depend on how much stock is purchased.

You can sell shares later and reinvest the profits into more shares. You will keep receiving dividends for as long as you live.