The complicated question of what constitutes a good debt-to-income ratio is one that is often asked. It depends on many factors, including your lifestyle and goals, your income level, and your tolerance for financial risk. It is possible to calculate your ratio in a number of ways so you can get as close to your ideal value as possible.

Calculating a good ratio of debt to income

Lenders use the debt-to–income ratio to assess a borrower’s finances. Lenders will take into account a range of factors to determine the appropriate debt-to-income ratio. These include the level of debt, income, and job stability.

The main criteria mortgage lenders use to determine eligibility for loans is the debt-to-income ratio. It is calculated by taking the total monthly debt payments and dividing them by the gross monthly income. Gross monthly income, or the sum of all money before taxes and deductions, is the amount that you earn each month. In the calculation are also included minimum payments such as mortgage payments and recurring monthly fee.

The debt-toincome ratio is calculated by adding all monthly obligations, including minimum car and credit card payments, student loan payments and student loans payments. Next, add up the monthly obligations, including mortgage payment, property taxes. homeowners insurance and homeowner's association fees. You can also add the amount of credit that appears on your credit reports.

Reducing your debt by lowering your debt-to-income ratio

Consider your debt-to–income ratio (DTI), before you apply for a loan. The better your DTI, You can improve your debt to income ratio by paying down debts and consolidating credit cards.

You can lower your DTI by lowering the interest rates on your loans. This can be achieved by refinancing and negotiating with your creditors. Although you may be able to extend the loan's term to lower your monthly payments and get a lower interest rate, it is possible to increase your monthly payments. In addition, this solution leaves you vulnerable to unexpected shocks in your income. You can also consider a side-job to increase your income or reduce your debt to income ratio.

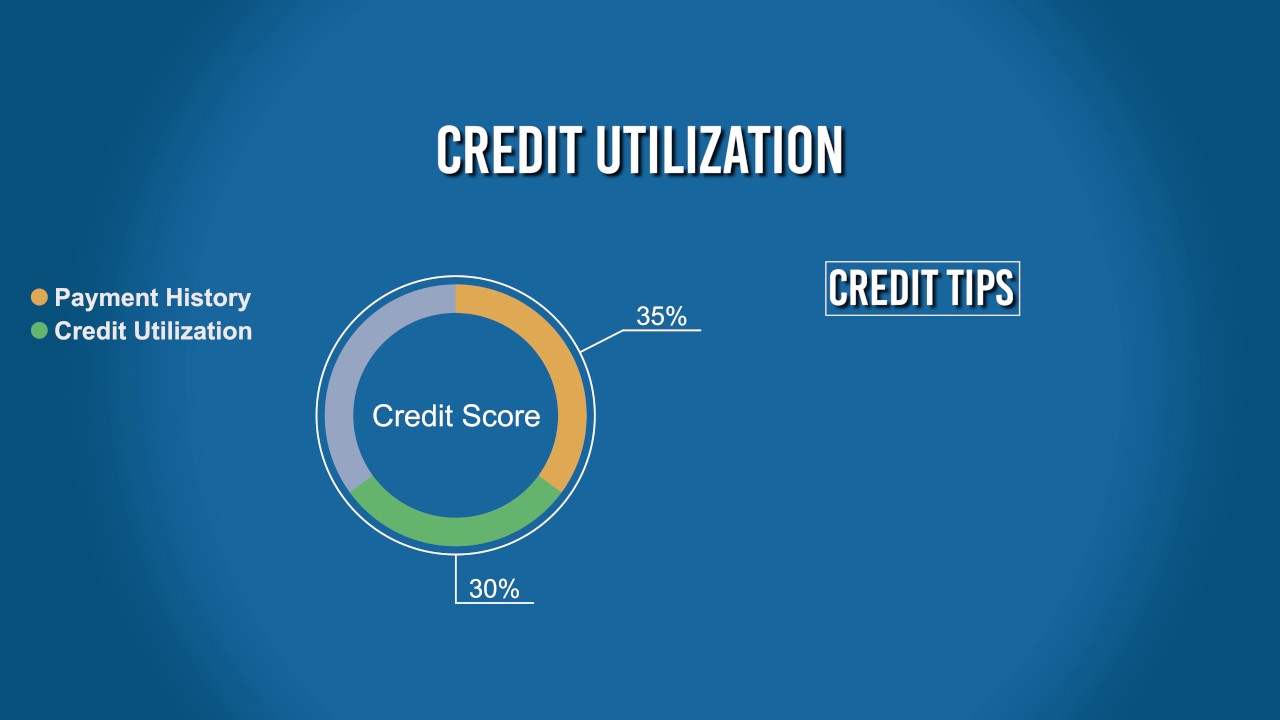

The ideal ratio should not exceed 35%. You should take drastic steps to lower your personal debt-to income ratio if it is greater than 35%.

FAQ

How to build a passive income stream?

To earn consistent earnings from the same source, it is important to understand why people make purchases.

That means understanding their needs and wants. Learn how to connect with people to make them feel valued and be able to sell to them.

The next step is to learn how to convert leads in to sales. To keep clients happy, you must be proficient in customer service.

Although you might not know it, every product and service has a customer. You can even design your entire business around that buyer if you know what they are.

A lot of work is required to become a millionaire. It takes even more work to become a billionaire. Why? Because to become a millionaire, you first have to become a thousandaire.

And then you have to become a millionaire. Finally, you must become a billionaire. You can also become a billionaire.

How do you become a billionaire. You must first be a millionaire. You only need to begin making money in order to reach this goal.

Before you can start making money, however, you must get started. So let's talk about how to get started.

What is the easiest passive income?

There are tons of ways to make money online. Most of them take more time and effort than what you might expect. So how do you create an easy way for yourself to earn extra cash?

Find something that you are passionate about, whether it's writing, design, selling, marketing, or blogging. That passion can be monetized.

For example, let's say you enjoy creating blog posts. You can start a blog that shares useful information about topics in your niche. Then, when readers click on links within those articles, sign them up for emails or follow you on social media sites.

This is affiliate marketing. There are lots of resources that will help you get started. For example, here's a list of 101 Affiliate Marketing Tools, Tips & Resources.

You could also consider starting a blog as another form of passive income. This time, you'll need a topic to teach about. However, once you've established your site, you can monetize it by offering courses, ebooks, videos, and more.

Although there are many ways to make money online you can choose the easiest. Focus on creating websites or blogs that offer valuable information if you want to make money in the online world.

Once you've built your website, promote it through social media sites like Facebook, Twitter, LinkedIn, Pinterest, Instagram, YouTube and more. This is known content marketing.

How much debt can you take on?

It is essential to remember that money is not unlimited. Spending more than you earn will eventually lead to cash shortages. Savings take time to grow. You should cut back on spending if you feel you have run out of cash.

But how much is too much? There isn't an exact number that applies to everyone, but the general rule is that you should aim to live within 10% of your income. Even after years of saving, this will ensure you won't go broke.

This means that you shouldn't spend more money than $10,000 a year if your income is $10,000. If you make $20,000 per year, you shouldn't spend more then $2,000 each month. Spend no more than $5,000 a month if you have $50,000.

This is where the key is to pay off all debts as quickly and easily as possible. This includes student loans, credit cards, car payments, and student loans. When these are paid off you'll have money left to save.

It's best to think about whether you are going to invest any of the surplus income. You could lose your money if you invest in stocks or bonds. You can still expect interest to accrue if your money is saved.

As an example, suppose you save $100 each week. It would add up towards $500 over five-years. After six years, you would have $1,000 saved. In eight years you would have almost $3,000 saved in the bank. When you turn ten, you will have almost $13,000 in savings.

Your savings account will be nearly $40,000 by the end 15 years. It's impressive. You would earn interest if the same amount had been invested in the stock exchange during the same period. Instead of $40,000 in savings, you would have more than 57,000.

You need to be able to manage your finances well. If you don't, you could end up with much more money that you had planned.

What's the difference between passive income vs active income?

Passive income is when you make money without having to do any work. Active income requires hard work and effort.

Your active income comes from creating value for someone else. It is when someone buys a product or service you have created. You could sell products online, write an ebook, create a website or advertise your business.

Passive income is great as it allows you more time to do important things while still making money. Most people aren’t keen to work for themselves. Instead, they decide to focus their energy and time on passive income.

The problem is that passive income doesn't last forever. If you hold off too long in generating passive income, you may run out of cash.

Also, you could burn out if passive income is not generated in a timely manner. It is best to get started right away. If you wait to start earning passive income, you might miss out opportunities to maximize the potential of your earnings.

There are three types to passive income streams.

-

These include starting a business, owning a franchise or becoming a freelancer. You could also rent the property, such as real-estate, to other people.

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real Estate includes flipping houses, purchasing land and renting properties.

Why is personal financial planning important?

A key skill to any success is personal financial management. In a world of tight money, we are often faced with difficult decisions about how much to spend.

Why then do we keep putting off saving money. Is there something better to invest our time and effort on?

Yes, and no. Yes because most people feel guilty about saving money. No, because the more money you earn, the more opportunities you have to invest.

If you can keep your eyes on what is bigger, you will always be able spend your money wisely.

You must learn to control your emotions in order to be financially successful. Negative thoughts will keep you from having positive thoughts.

It is possible to have unrealistic expectations of how much you will accumulate. This is because you aren't able to manage your finances effectively.

Once you have mastered these skills you will be ready for the next step, learning how budgeting works.

Budgeting is the act or practice of setting aside money each month to pay for future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

So now that you know how to allocate your resources effectively, you can begin to look forward to a brighter financial future.

Which side hustles are most lucrative?

Side hustle is an industry term that refers to any additional income streams that supplement your main source.

Side hustles are important because they make it possible to earn extra money for fun activities as well as bills.

Side hustles not only help you save money for retirement but also give you flexibility and can increase your earning potential.

There are two types of side hustles: passive and active. Online side hustles can be passive or active. These include ecommerce shops, blogging and freelancing. Some examples of active side hustles include dog walking, tutoring and selling items on eBay.

Side hustles that are right for you fit in your daily life. Start a fitness company if you are passionate about working out. If you enjoy spending time outdoors, consider becoming a freelance landscaper.

You can find side hustles anywhere. Side hustles can be found anywhere.

One example is to open your own graphic design studio, if graphic design experience is something you have. Perhaps you're an experienced writer so why not go ghostwriting?

Whatever side hustle you choose, be sure to do thorough research and planning ahead of time. You'll be ready to grab the opportunity when it presents itself.

Remember, side hustles aren't just about making money. Side hustles are about creating wealth and freedom.

There are so many opportunities to make money that you don't have to give up, so why not get one?

Statistics

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

External Links

How To

Get passive income ideas to increase cash flow

You don't have to work hard to make money online. Instead, there are ways for you to make passive income from home.

Automating your business could be a benefit to an already existing company. Automation can be a great way to save time and increase productivity if you're thinking of starting a new business.

Your business will become more efficient the more it is automated. This means you will be able to spend more time working on growing your business rather than running it.

Outsourcing tasks is an excellent way to automate them. Outsourcing lets you focus on the most important aspects of your business. When you outsource a task, it is effectively delegating the responsibility to another person.

This means that you can focus on the important aspects of your business while allowing someone else to manage the details. Outsourcing allows you to focus on the important aspects of your business and not worry about the little things.

A side hustle is another option. Another way to make extra money is to use your talents and create a product that can be sold online.

If you like writing, why not create articles? There are plenty of sites where you can publish your articles. These websites offer a way to make extra money by publishing articles.

It is possible to create videos. You can upload videos to YouTube and Vimeo via many platforms. These videos will bring traffic to your site and social media pages.

Another way to make extra money is to invest your capital in shares and stocks. Investing in shares and stocks is similar to investing real estate. You are instead paid rent. Instead, you receive dividends.

They are included in your dividend when shares you buy are purchased. The amount of your dividend will depend on how much stock is purchased.

You can sell shares later and reinvest the profits into more shares. This way you'll continue to be paid dividends.